EURUSD H4 Technical and Fundamental Analysis for 25.07.2024

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/USD forecast today is currently influenced by a series of upcoming economic events and data releases. For the USD, key events include speeches from FOMC members Bowman and Logan, as well as President Biden's announcement. High-impact data such as the Advance GDP q/q, Unemployment Claims, and Durable Goods Orders will also play crucial roles. These events are likely to provide significant volatility in the market. In the Eurozone, the Ifo Business Climate Index and ECB-related announcements will shape market sentiment. Strong US economic data and hawkish tones from FOMC members may strengthen the USD, potentially pushing the EUR/USD pair, also known as the Fiber, lower.

Price Action:

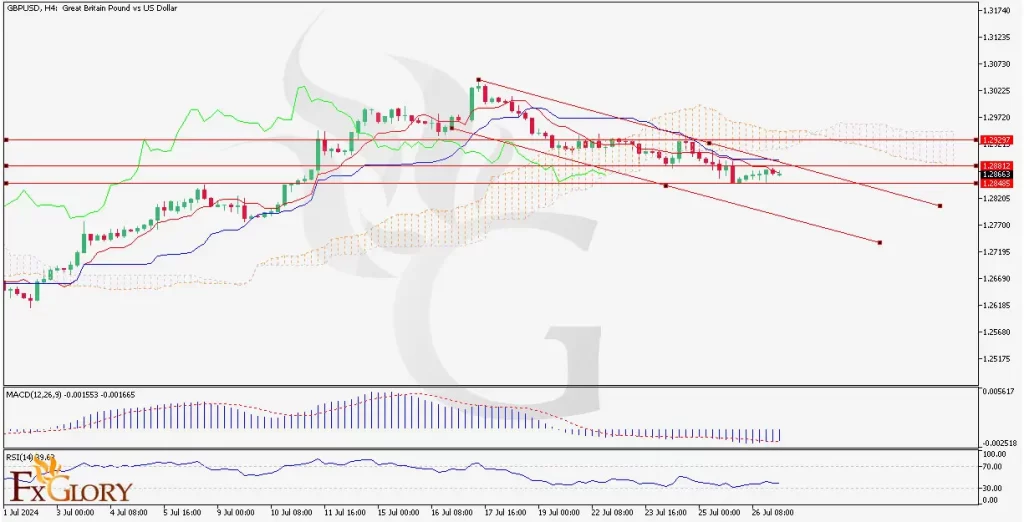

The EUR/USD H4 chart has recently broken below the Ichimoku cloud, indicating a shift to a bearish trend. The pair is experiencing a downward movement, forming lower highs and lower lows, typical of a bearish trend. The pairís price action suggests continued downward pressure, with the price finding resistance at the lower boundary of the Ichimoku cloud.

Key Technical Indicators:

Ichimoku Cloud: The price breaking below the Ichimoku cloud is a bearish signal. The future cloud is bearish as well, with Span A below Span B, indicating potential continued downward momentum.

RSI (Relative Strength Index): The RSI is around 35.39, which is close to the oversold territory. This indicates that while the bearish momentum is strong, there may be limited room for further immediate decline before a potential correction.

MACD (Moving Average Convergence Divergence): The MACD indicator shows a negative histogram with the MACD line below the signal line, reinforcing the bearish sentiment. This suggests that downward momentum is currently prevailing.

Support and Resistance:

Support Levels: Immediate support is found at 1.08345, with stronger support at 1.08000.

Resistance Levels: Immediate resistance is at 1.08574, followed by 1.08870 and 1.09039. A break above these levels would be required to negate the current bearish trend.

Conclusion and Consideration:

The EUR/USD technical analysis on the H4 chart is exhibiting bearish tendencies, confirmed by the price breaking below the Ichimoku cloud and negative signals from the MACD. The RSI suggests the pair is nearing oversold conditions, which could lead to a short-term corrective bounce. However, the overall sentiment remains bearish unless significant resistance levels are breached. As for the Fiberís fundamental analysis today, traders should closely monitor the upcoming economic data releases and FOMC speeches for further direction. Proper risk management, such as setting stop losses, is crucial in this volatile environment.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.

FXGlory

25.07.2024

4Likes

4Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks