EURCAD Daily Technical and Fundamental Analysis for 21.06.2024

Time Zone: GMT +3

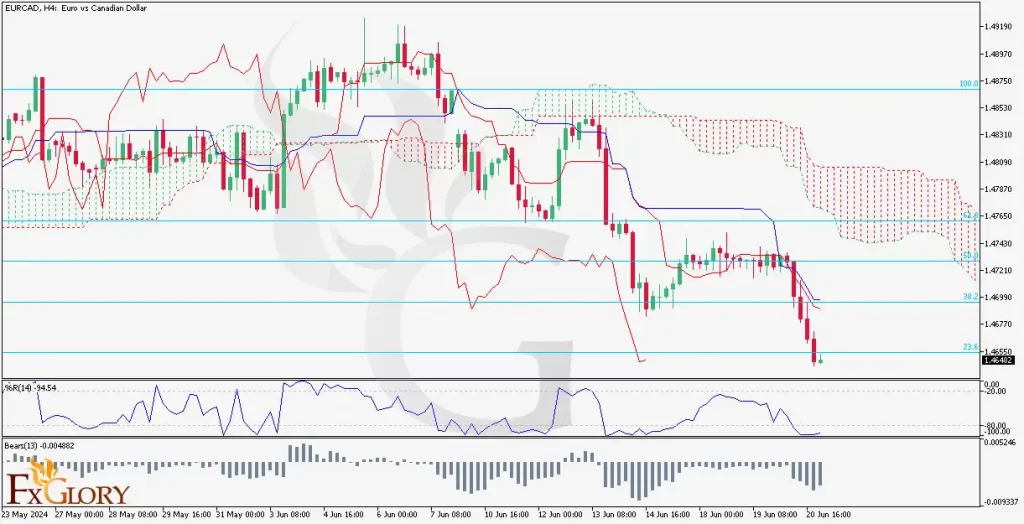

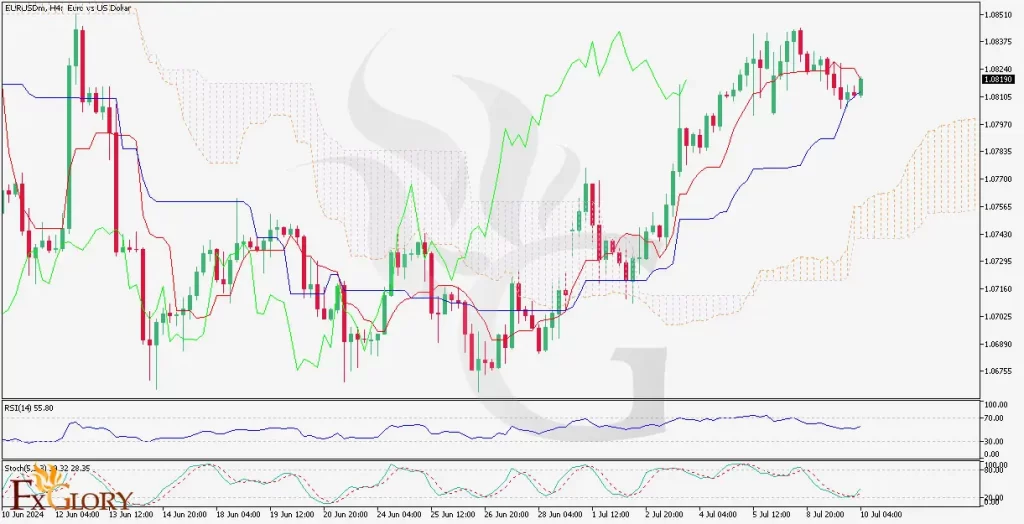

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EUR/CAD currency pair reflects the exchange rate between the Euro (EUR) and the Canadian Dollar (CAD). Today, the market expects several news releases for both currencies. For the EUR, significant events include the German Flash Manufacturing PMI (forecasted at 46.4) and the French Flash Services PMI (forecasted at 50.0), both indicating varying degrees of economic activity. Additionally, speeches from key officials like German Buba President Nagel and ECOFIN meetings could provide further market direction. For the CAD, the focus will be on the Core Retail Sales m/m (forecasted at 0.5%) and Retail Sales m/m (forecasted at 0.7%), which are essential indicators of consumer spending and economic health.

Price Action:

Analyzing the EURCAD H4 chart, the pair has shown a sharp bearish trend. The last five bearish candles have driven the price down from the 50.0 Fibonacci retracement line towards the 23.6 Fibonacci retracement line, with the latest candle being green and bullish, indicating a potential pullback. This recent bullish candle at the 23.6 Fibonacci level suggests that this support level might hold, at least in the short term.

Key Technical Indicators:

Ichimoku Cloud: The Ichimoku Cloud indicator shows that the EUR-CAD forex pair is currently in a bearish trend. The price is below the Kumo (cloud), indicating a bearish bias. The Tenkan-sen (red line) and Kijun-sen (blue line) lines are both above the price, reinforcing the bearish outlook. The Senkou Span A and B (cloud boundaries) are also indicating resistance ahead.

Williams %R: The Williams %R (14) is currently at -94.54, which is in the oversold territory. This suggests that the pair might be due for a short-term rebound or consolidation as the selling pressure may have been exhausted.

Bears Power (13): The Bears Power indicator shows negative values, indicating that the sellers are still in control. However, the indicator has shown a slight uptick recently, which could suggest that the bearish momentum is weakening slightly.

Support and Resistance:

Support: The immediate support level is at the 23.6% Fibonacci retracement line (1.4645), which coincides with the recent green candle and could act as a strong support level.

Resistance: The nearest resistance level is at the 38.2% Fibonacci retracement line (1.4710), which aligns with a previous consolidation area and could pose a challenge for the bulls if the price attempts to recover.

Conclusion and Consideration:

The EURCAD pair on the H4 chart shows a strong bearish momentum supported by the Ichimoku Cloud, %R14, and Bears Power indicators. The recent bearish candles indicate that the selling pressure is still present, but the oversold condition of %R14 and the latest bullish candle suggest a possible short-term pullback or consolidation at the 23.6% Fibonacci retracement level. Traders should watch the key support and resistance levels closely, as any breach could indicate the next potential move. Given the upcoming economic releases and speeches, increased volatility can be expected, and traders should stay updated with the latest information.

Disclaimer: The EURCAD technical and fundamental analysis provided is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions. Market conditions can change rapidly, and it is essential to stay updated with the latest information.

FXGlory

21.06.2024

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks