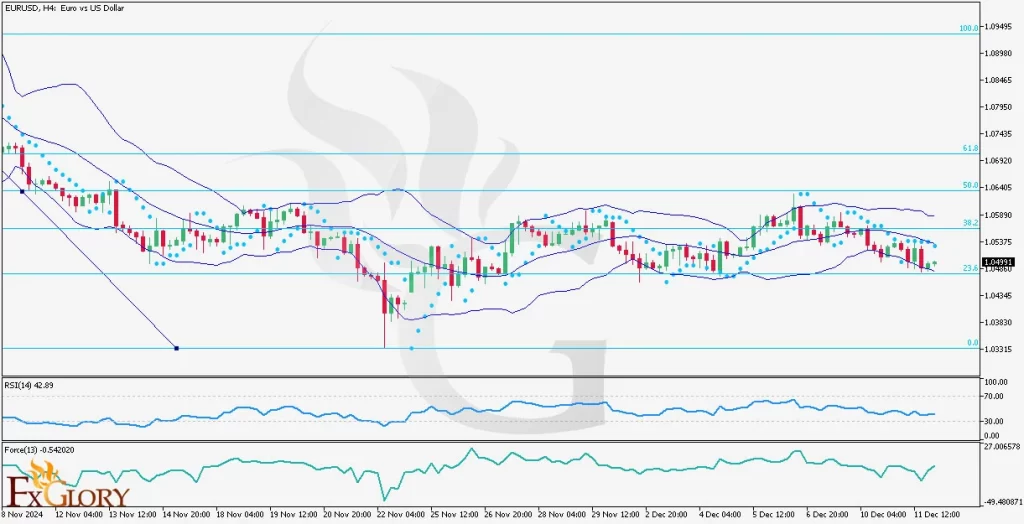

EURUSD H4 Technical and Fundamental Analysis for 12.12.2024

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis

Today, the EURUSD pair will be influenced by multiple economic releases from both the Eurozone and the United States. On the Eurozone side, the IT Quarterly Unemployment Rate and the ECB Main Refinancing Rate are scheduled for release. A lower-than-expected unemployment rate and a higher-than-expected interest rate would be positive for the Euro. On the US side, the Core PPI m/m, PPI m/m, and Unemployment Claims data will be released. Higher-than-expected inflation figures and lower-than-expected jobless claims would be positive for the US Dollar. Traders should closely monitor these releases as they could significantly impact the pair's price action.

Price Action

The EURUSD pair has been trading within a range in recent weeks, consolidating after a previous bullish trend. The current price action suggests a potential breakout in either direction, depending on the upcoming economic data and market sentiment. The pair is currently trading near the middle of its Bollinger Bands, indicating a period of low volatility.

Key Technical Indicators

Bollinger Bands: The narrowing Bollinger Bands suggest a period of low volatility, which could be followed by a significant price move.

RSI (Relative Strength Index): The RSI is currently at 42.89, below the oversold level of 30, indicating that the Euro is undervalued relative to the US Dollar. This could lead to a bullish correction in the short term.

Parabolic SAR: The Parabolic SAR dots are plotted above the candles, indicating a bearish trend. However, the recent flattening of the dots suggests a potential slowdown in the bearish momentum.

Force Index 13: The Force Index 13 is currently at -0.542020, indicating weak bearish momentum. A positive value would signal a shift in momentum to bullish.

Support and Resistance

Support: The immediate support level is located at 1.03315, followed by 1.03830.

Resistance: The nearest resistance level is at 1.04345, followed by 1.04991.

Conclusion and Considerations

The EURUSD pair is currently trading in a range, with potential for a breakout in either direction. The upcoming economic releases from both the Eurozone and the US will be crucial in determining the pair's future direction. Traders should monitor these releases closely and adjust their positions accordingly. It is important to note that the EURUSD pair can be highly volatile, and traders should use stop-loss orders to manage risk.

Disclaimer: The analysis provided for EUR/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURUSD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

12.12.2024

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks