EURCAD Daily Technical and Fundamental Analysis for 11.25.2024

Time Zone: GMT +2

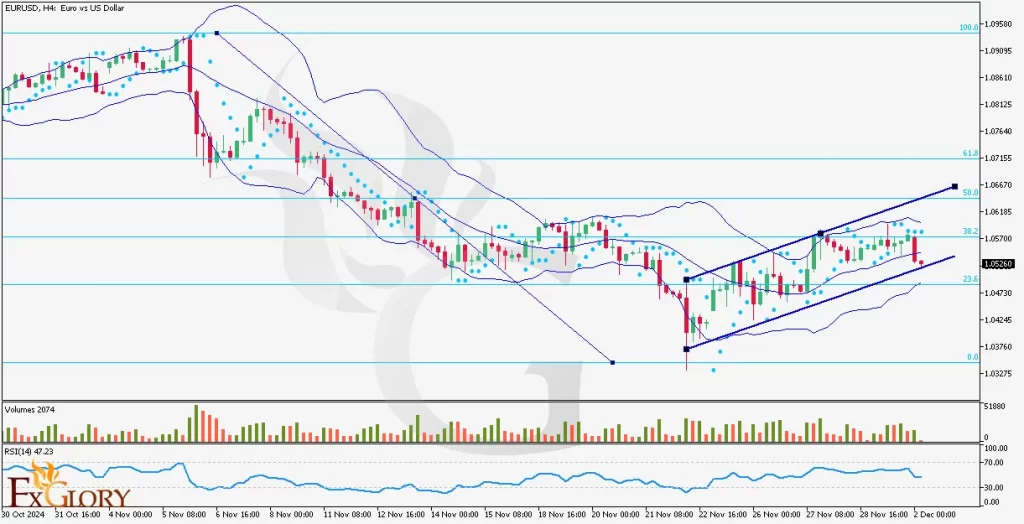

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The EURCAD pair is influenced today by key news releases for both the Eurozone and Canada. For the Euro, significant market-moving events include the German ifo Business Climate Index, the Belgian National Bank Business Confidence survey, and a speech by ECB member Joachim Nagel. The ifo survey, being a leading economic health indicator, is expected to shape sentiment toward Eurozone growth, while Nagelís remarks could provide insight into future ECB monetary policy directions. Meanwhile, for Canada, quarterly corporate earnings data is scheduled. Positive results could support CAD by indicating improved business conditions. This fundamental backdrop sets the stage for a potentially volatile trading session, with traders looking for signals from economic indicators and central bank rhetoric.

Price Action:

On the H4 timeframe, EURCAD is in a bearish trend, with the pair posting lower highs and lower lows. Recent price action has demonstrated a clear breakdown below the mid-line of the Bollinger Bands, confirming downward momentum. The latest candles are forming near the lower Bollinger Band, hinting at oversold conditions. However, the lack of strong reversal signals suggests the bearish trend may persist, albeit with potential retracements.

Key Technical Indicators:

Bollinger Bands: The price is trading in the lower half of the Bollinger Bands, with recent candles hugging the lower band. This confirms strong bearish momentum but also suggests the potential for a pullback. Narrowing bands indicate decreasing volatility, often preceding a breakout or trend continuation.

Stochastic Oscillator: The Stochastic Oscillator has just exited the oversold zone (crossing above 20), signaling a possible corrective bounce in the near term. However, the overall trend remains bearish, and the signal lacks strong upward momentum.

MACD (Moving Average Convergence Divergence): The MACD line remains below the signal line, with a declining histogram. This bearish setup indicates sustained selling pressure, with no immediate signs of a reversal.

Parabolic SAR: The Parabolic SAR dots are positioned above the candles, signaling a continuation of the bearish trend. Recent adjustments in the SAR position reaffirm the downward momentum, though traders should watch for any flips to signal potential trend shifts.

Support and Resistance:

Support: The 1.4492 level serves as a key support, representing previous lows. A breach of this level could intensify the ongoing bearish momentum.

Resistance: The 1.4722 level stands as the closest resistance, corresponding to the recent breakdown area and the mid-point of the Bollinger Bands. Any upward retracement is likely to encounter selling pressure around this level.

Conclusion and Consideration:

The EURCAD H4 chart reveals a strong bearish trend supported by technical indicators like Bollinger Bands, MACD, and Parabolic SAR. While the Stochastic Oscillator hints at a minor retracement, the overall sentiment remains bearish. Upcoming fundamental events, including the ifo survey and Canadian corporate earnings, could inject volatility, making the 1.4492 support level crucial for monitoring further price action. Traders should remain cautious, especially with potential reversals from oversold conditions, while closely observing fundamental triggers.

Disclaimer: The analysis provided for EUR/CAD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on EURCAD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

11.25.2024

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks