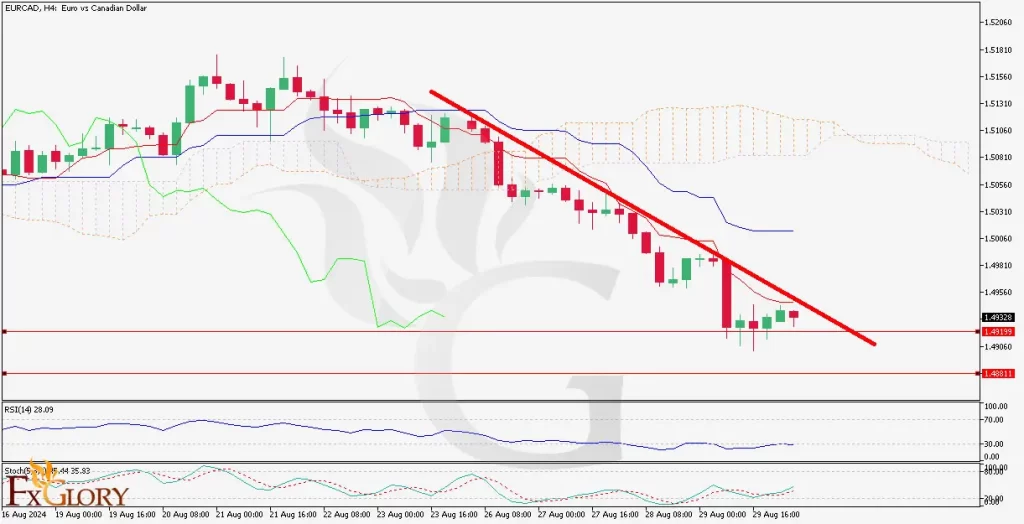

EUR/CAD H4 Technical and Fundamental Analysis for 08.30.2024

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The upcoming economic data releases from both the US and Japan are set to influence the USD/JPY pair's direction prediction. In the US, key indicators such as the S&P/CS Composite-20 HPI y/y, HPI m/m, CB Consumer Confidence, and Richmond Manufacturing Index will be released. The S&P/CS Composite-20 HPI y/y is expected to show a slight decrease from 6.8% to 6.2%, indicating a cooling in the housing market. Meanwhile, the CB Consumer Confidence index is expected to rise to 100.9 from a previous 100.3, suggesting improved consumer sentiment. The Richmond Manufacturing Index is projected to show an improvement from -17 to -14, which still indicates contraction but at a slower pace. These mixed data points could create a volatile trading environment for the USD.

On the Japanese side, the Services Producer Price Index (SPPI) y/y is forecasted to slightly decrease from 3.0% to 2.9%, signaling a potential slowdown in price pressures; which stands as an important forecast element for this fore pair. The BOJ Core CPI y/y is expected to remain stable at 2.1%, suggesting persistent inflation concerns within Japan. The stable inflation rate and the recent dovish stance of the Bank of Japan could continue to exert downward pressure on the JPY.

Price Action:

The USD/JPY pair is forming a bearish flag pattern on the H4 chart after a significant bearish wave, which suggests a potential continuation of the downward trend. The price is currently consolidating within this pattern, and a breakout to the downside could accelerate the bearish momentum. However, the presence of bullish technical indicators points to a possible short-term corrective wave.

Key Technical Indicators:

Support Levels: The immediate support is at 1.4881. A break below this level could see the pair testing lower support zones, which may align with historical lows.

Resistance Levels: The immediate resistance is the descending trend line. A successful breakout above this line, confirmed with a close above 1.4932, could indicate a shift to a bullish phase, targeting higher resistance areas.

Support and Resistance:

Support Levels: The nearest support is at the lower trendline of the bearish flag pattern, around 144.00. A break below this level could see the pair testing the next support near 142.50, which aligns with previous lows.

Resistance Levels: Immediate resistance is at the upper trendline of the bearish flag, around 145.00. A break above this level could target the next resistance at 146.50, potentially invalidating the bearish flag pattern and signaling a bullish reversal.

Conclusion and Consideration:

The EUR/CAD H4 chart suggests that while the pair is in a bearish trend, technical indicators are showing signs of a potential short-term reversal due to bullish divergence and oversold conditions. Fundamental factors, including weaker-than-expected Eurozone inflation data and slightly weaker Canadian GDP figures, could provide mixed influences on the pair. Traders should closely monitor the price action around the descending trend line for potential breakout opportunities, either to the upside for a buy signal or to the downside below the support level for a sell signal.

Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.

FXGlory

08.30.2024

4Likes

4Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks