Talking Points:

- Price action is an extremely common tool for day-traders’ (scalpers) risk management approaches.

- Moving averages and psychological support and resistance can assist with entry and trade management.

Price Action

The first indicator is more than an indicator, and closer to a ‘field-of-study’ within technical analysis. Because trading on short-term time frames exposes traders to the complexity of ‘lag’ within a market, price action is one of the more popular ways of performing technical analysis with a short-term approach.

The reason this is so popular is because price action removes technical indicators from the equation and instead focuses on price and price alone. Price action can be used to grade trends, identify support and resistance levels, and to show traders potential entry opportunities in markets.

Where price action can come in as especially valuable for a short-term trader is in the realm of trade and risk and trade management. By noting price levels with which reversals or changes in market direction have taken place in the past, traders can look to place stops on positions so that if the market breaks against them (if a new low is put in while in a long position, or a new high while in a short position), the trade can be closed in an effort to mitigate the loss.

Price action can be a valuable tool for risk and trade management

If the market does trend in the direction that you’re looking for, price action can also help with adjusting stops and profit-taking.

Short-term traders will often look to execute a quick break-even stop to remove their initial risk from the trade. And after prices do continue to move, traders can look at moving the stop even deeper in-the-money as the trade works in the trader’s favor.

Moving Averages

Another indicator that’s simple to use and attempts to marginalize the lag that is ever-present with the usage of indicators, the moving average is a common chart component of short-term traders.

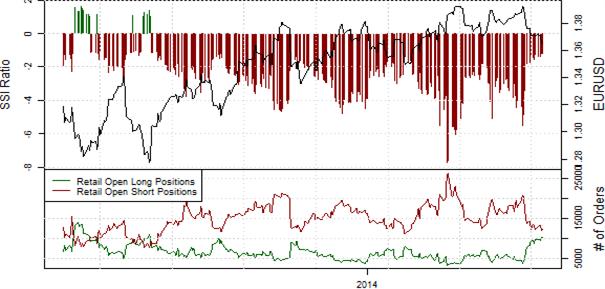

Moving averages are commonly used for trend diagnoses, so that if prices are above the moving average the trend is diagnosed as being ‘up,’ and if prices are below the trend is considered being ‘down.’ This can work phenomenally with a multiple time frame approach in which trends are being graded on a longer-term chart (like the hourly or 4-hour), and entries performed on the shorter-term chart.

Traders can also use moving averages to trigger into new positions. The moving average crossover is one of the more common ways of doing so and with this method; traders are simply looking for price to cross the moving average to initiate the position.

This strategy uses Moving Averages for trend filter and entry trigger, and price action for risk management

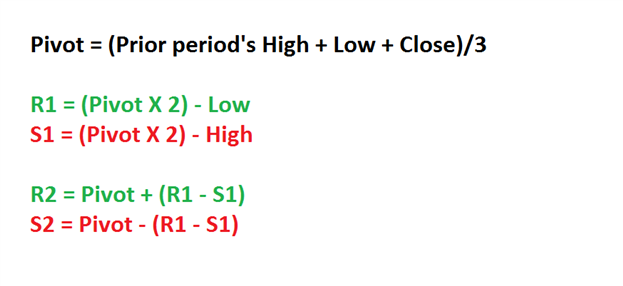

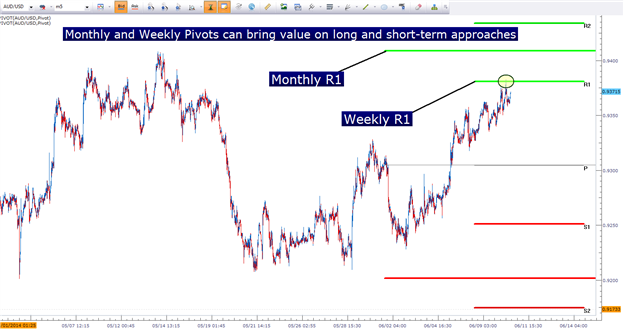

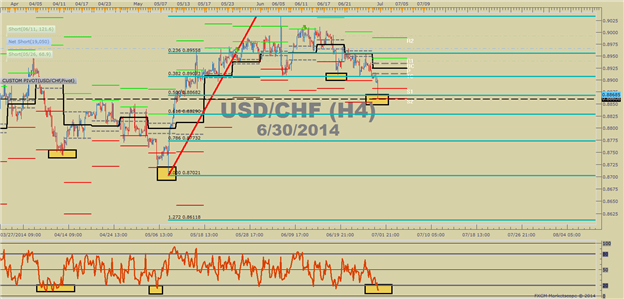

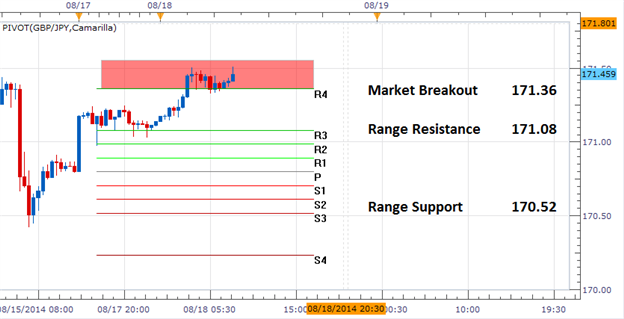

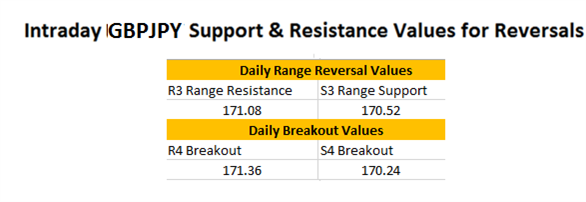

Support and Resistance via Psychological Whole Numbers, and Pivot Points

Have you ever been in a trade that’s working out great, only to see that up-trend stop dead-in-its-tracks? And after price struggles to continue moving up, it begins to oscillate before reversing and moving down.

This is the story of support and resistance, and to short-term traders this can take on extreme importance because failure to see ‘the bigger picture’ can lead to confusion and losses on the shorter-term charts.

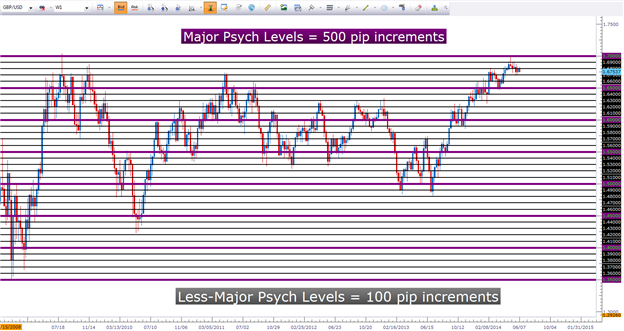

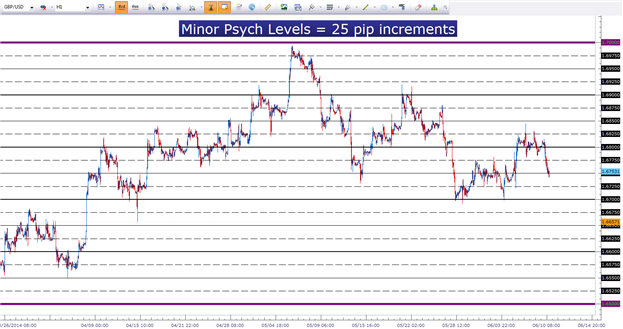

There are numerous ways to identify support and resistance, and traders can use price action to validate any particular level; but this really only comes into play after-the-fact. Of particular interest to short-term traders are ‘psychological whole numbers.’

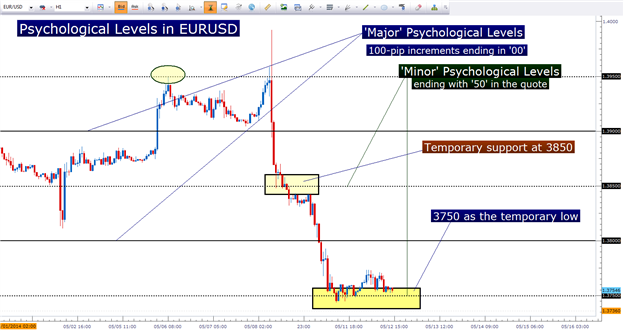

Psychological whole numbers are simply even, rounded values on the chart. As an example 1.3900, 1.3800 and 1.3700 are ‘round’ whole numbers in EURUSD, as each of these prices end in ’00.’ But we can take this a step further with the values mid-way between these three levels, 1.3850 and 1.3750 are also ‘rounded whole numbers.’

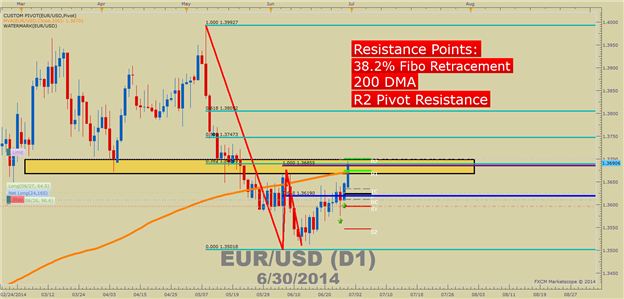

Take a look at the most recent move in EURUSD in the chart below, and notice how even in a strong-trending market the level of 1.3850 offered temporary support as the pair could not break through. Eight hours later that momentum came back in the market as the level finally yielded to selling, only to see 1.3750 come in as support shortly thereafter.

Psychological levels can have a huge bearing on price action

At this point, the pair has still failed to break below 1.3750 as support has come into the market after the most current 200+ pip run to the down-side.

Will every price ending in ‘50’ or ‘00’ elicit support or resistance? No. But short-term traders need to remain cognizant of the potential for support and resistance to develop at these values as trends move into new territory.

If a trend appears as though it may have run into a brick wall of support or resistance, traders can use this opportunity to scale out of a position, adjust stops, and or plan re-entries after prices finish retracing and continue moving in the trend-side direction.

--- Written by James Stanley

More...

---------

Psychological Levels

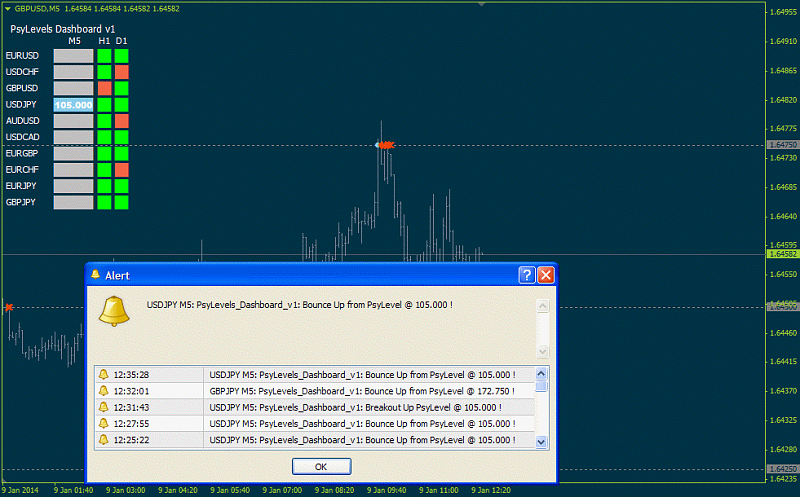

- PsyLevels_v2 indicator with template is here.

- PsyLevels_Dashboard_v1 indicator is on this post. Indicator is having the ability to watch the breakout and/or bounce levels on any number of currency pairs. Plus you can watch the candle direction on any number of time frames. The dashboard also have the popup/email alerts when the breakout/bounce direction matches with all candle directions.

- PsyLevels_v2.1 indicator is here. This version works with Metatrader 4 build 600 and above.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks