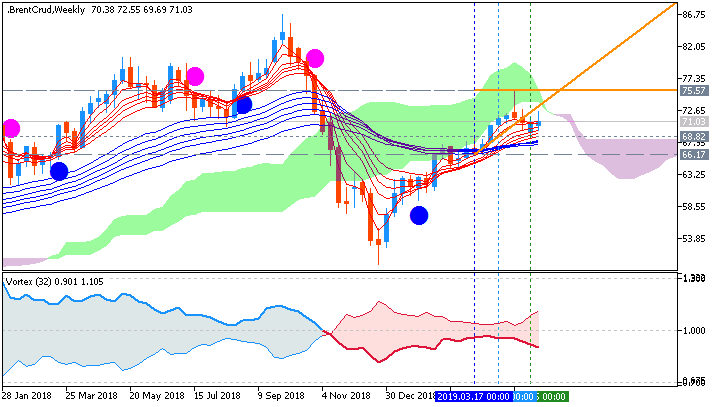

Today’s gains have helped offset a string of losses as fears over increasing oil output coupled with diminishing hopes that a US China trade deal will be reached. But, crude oil prices still remain above technical support at the 50.0 percent retracement level around $60.00/bbl drawn from October’s

peak and December’s bottom last year. Positive sentiment from a technical perspective has waned, however, after bullish uptrend support from the latest 40-plus percent rally was broken earlier this month. Now, a short-term bearish downtrend has formed while a downward-sloping 34-day EMA both look to serve as headwinds to further upside in oil prices.

Focusing in on a closer perspective, it appears that the 78.6 percent Fibonacci retracement level drawn from the high and low recorded on April 23 and May 6 respectively serves as a new area of confluence around the $61.50/bbl price. Oil bulls will likely watch this level closely to see if technical support continues to hold with the 61.8 percent and 50.0 percent Fibs encompassing the $62.50-63.20/bbl price level eyed as short-term upside targets. Although, if prices fail to hold footing above $60.00/bbl, crude could quickly accelerate to the downside.

more...

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks