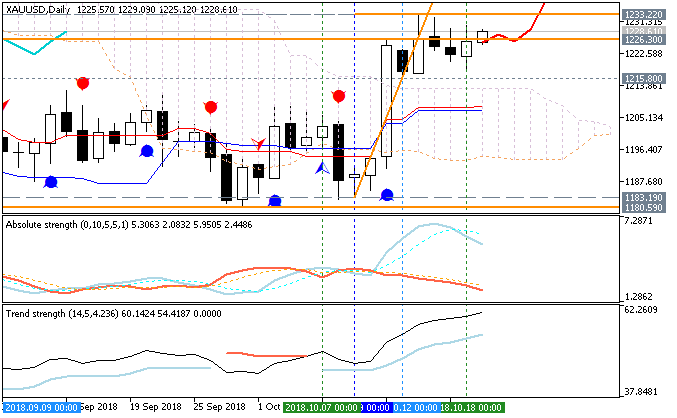

Spot Gold: Retail trader data shows 65.8% of traders are net-long with the ratio of traders long to short at 1.93 to 1. The number of traders net-long is 2.0% lower than yesterday and 2.0% higher from last week, while the number of traders net-short is 2.5% higher than yesterday and 14.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Spot Gold trading bias.

more...

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks