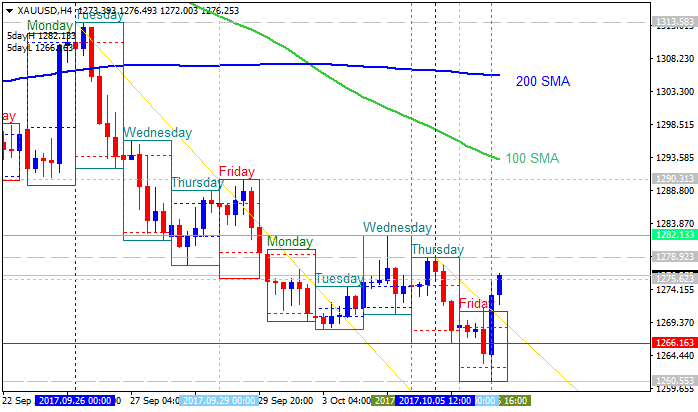

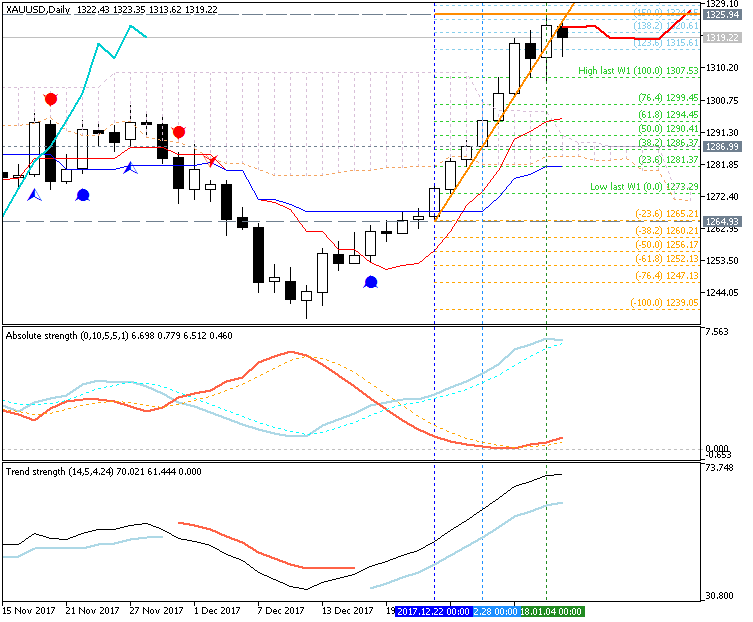

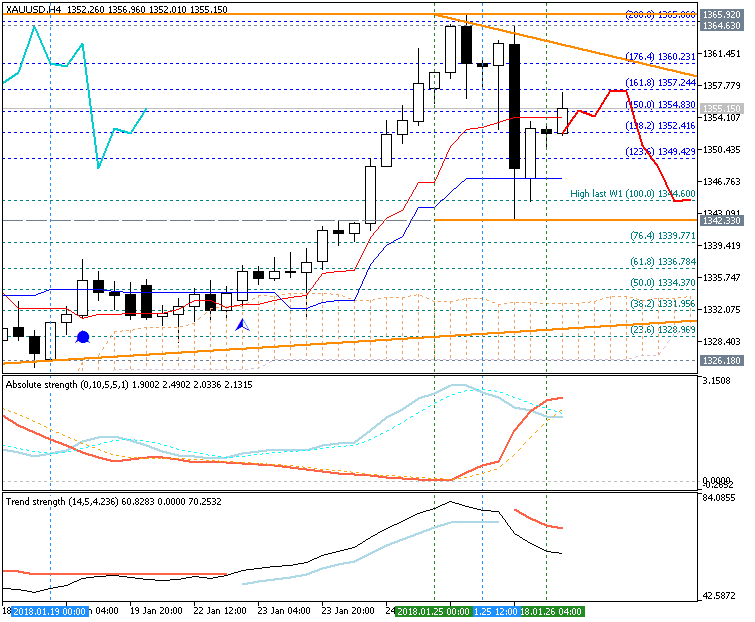

From an intraday perspective, we can count an impulse lower and we are seeing RSI divergence within the fifth wave. As a result, a bump higher may ensue to alleviate the oversold pressure. If a bounce develops, we are anticipating it to be a partial retracement of the September 10 October 6 down trend.

$1290-$1310 might be an initial zone of resistance. Any strength would be seen as corrective with the potential for another leg lower of similar size and length as the $97 per ounce down trend.

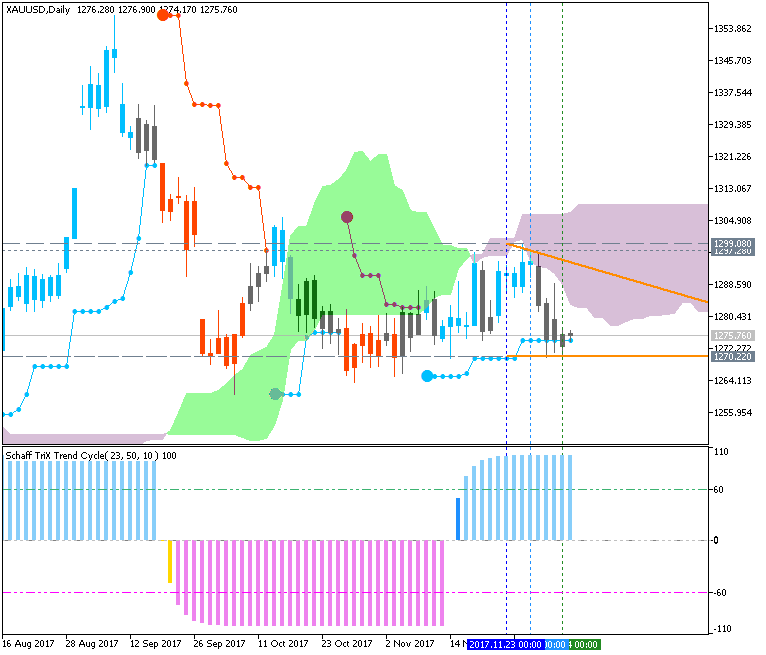

From a sentiment perspective, the ratio of net long traders has shot higher to +4.1. Sentiment is a good contrarian tool so with the majority of traders net long, we would use that as a signal to short.

more...

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks