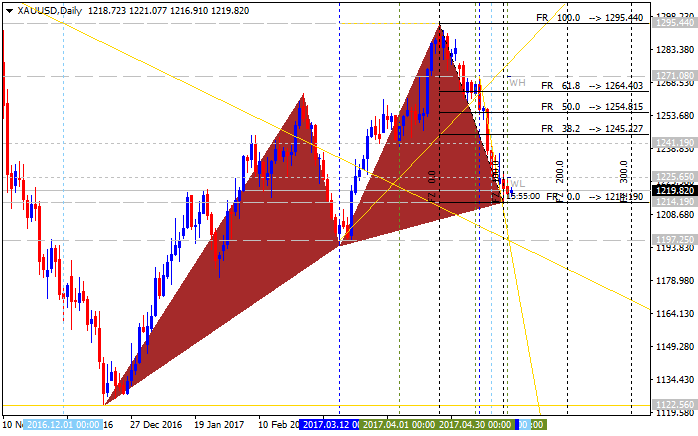

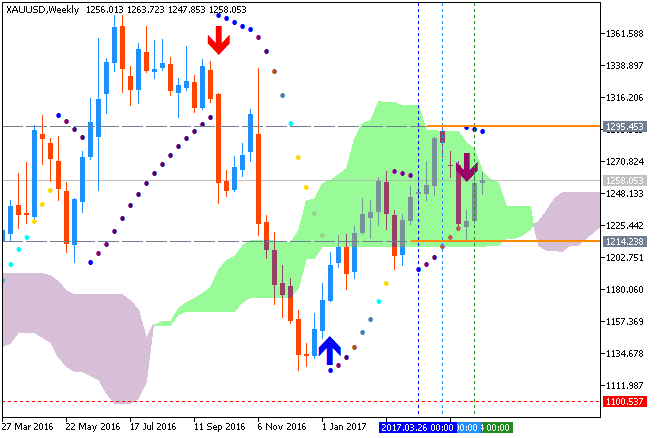

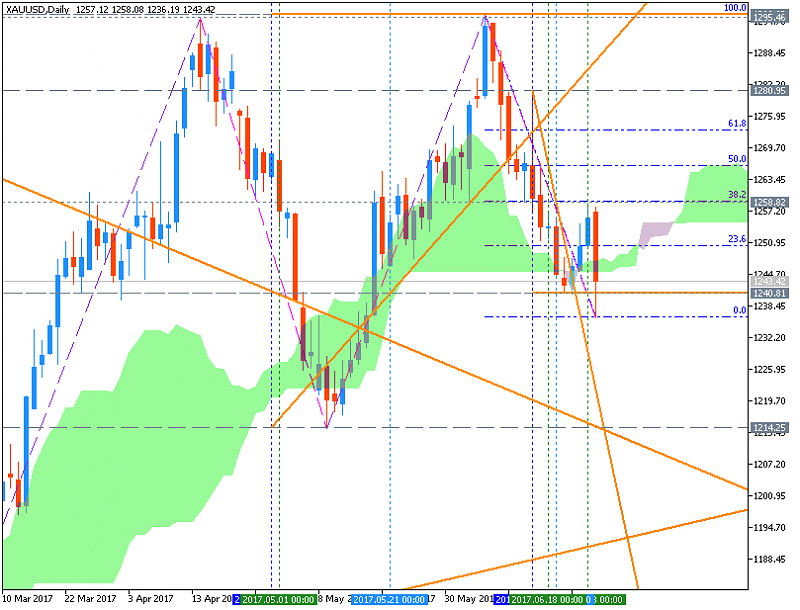

Gold prices have made little net progress over the past four months. Little net progress is typical of a corrective consolidative move. Gold prices, as of today, are still less than a 38% retracement of the December 2016 to February 2017 up trend. A shallow retracement of that nature suggests the longer term bull trend from December is not quite over.

Using Elliott Wave theory as a model, the sideways correction that began February 27 is likely a ‘B’ wave. Two higher probability patterns is that we are in a ‘B’ wave triangle or a ‘B’ wave flat pattern. Both patterns imply the same thing in that a bullish resolution eventually takes place. The start of the next bull run depends on which pattern (the triangle or the flat) emerges.

more...

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks