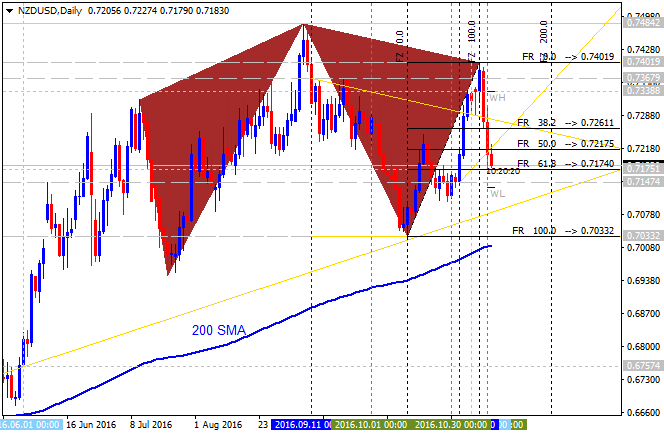

Daily price is located below 200-day SMA for the primary bullish market comndition. The price is breaking 10-day low level at 1.0650 to below for the bearish trend to be continuing.

If the price will break 1.0650 support level so the primary bearish market condition will be continuing.

If the price will break 10-day high at 1.0918 to above so the reversal of the price movement from the primary bearish to the primary bullish condition will be started.

If not so the price will be ranging within the levels.

Trend:

- D1 - bearish

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks