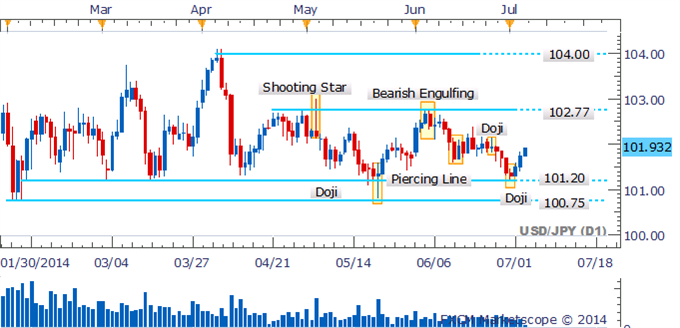

Talking Points:

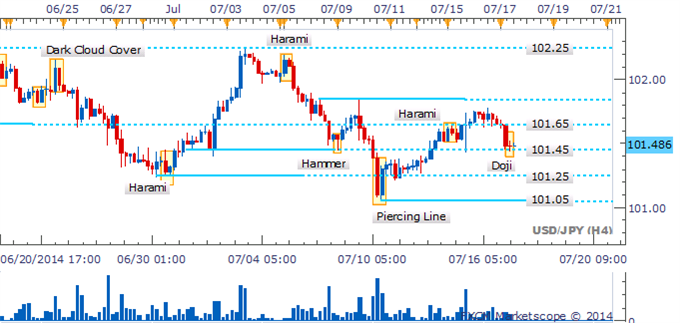

- USD/JPY Technical Strategy: Flat

- Support: 101.94-99 (38.2% Fib exp., channel top), 102.35 (23.6% Fib exp.)

- Resistance: 101.61 (50% Fib exp.), 101.28 (61.8% Fib exp.)

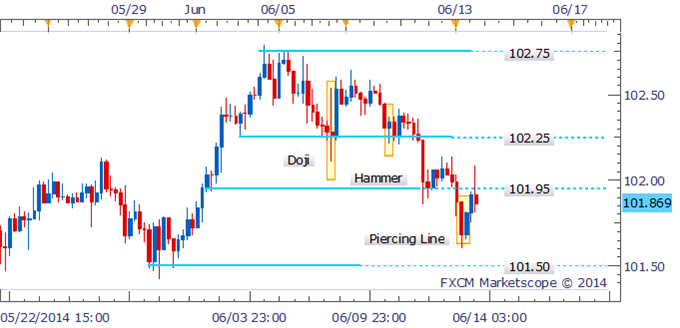

The US Dollar is attempting to extend its recovery against the Japanese Yen for a fourth consecutive trading day. Buyers are testing resistance in the 101.94-99 area, marked by the 38.2% Fibonacci expansion and the top of a falling channel that has guided prices over the past month. A daily close above this barrier exposes the 23.6% level at 102.35. Near-term support is at 101.61, the 50% Fib, with a turn back below that eyeing the 61.8% expansion at 101.28.

Prices are too close to resistance to justify a long position from a risk/reward perspective. On the other hand, the absence of a defined bearish reversal signal warns against taking up the short side. With that in mind, we remain flat for now.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

More...

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks