- "When the Yen strengthens as it has at the beginning of 2016, there is often stress in the global economy. So far, the JPY has strengthened by ~2.5% to start the year vs. the US Dollar while most currencies, most notably the commodity currencies have weakened aggressively. USD-JPY is in a precarious position much like the global economy is in a precarious position. Many expect a rally in risk, even if it is just a short-lived rally because we have been trained like Pavlov’s dog to expect a bounce when risk-aversion takes over in equities & JPY. However, the Fed is done easing, and is, in fact, tightening, and the truth about China is that we do not know how bad things are over there with certainty."

- "An important word of note, USD-JPY has shown a propensity to triangulate. For shorter-term traders who are keen on daily targets and invalidation levels, this may be no problem. However, for swing traders and multi-month triangle pattern can be frustrating and worth avoiding or turning to a shorter-term trading plan. Should a triangle be playing out again, support should hold at the August 24 low of 116.07 while the upside up towards the 61.8% retracement of the November-January range near 121.75."

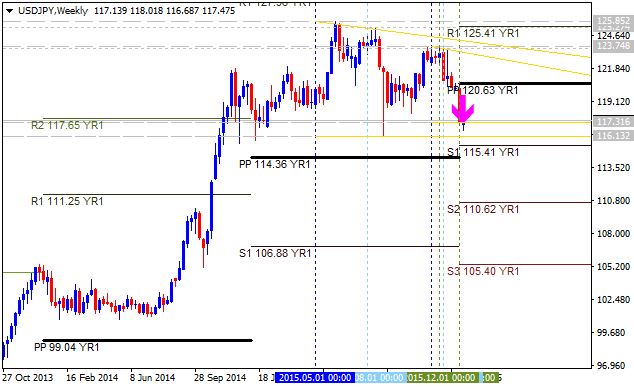

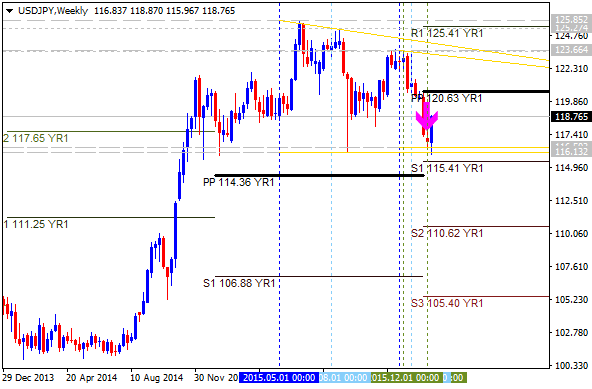

W1 price is located to be below yearly Central Pivot at 120.63: the price was reversed to the bearish condition by breaking Central Pivot from above to below for the S1 Pivot at 115.41 as the next target:

- If weekly price will break S1 Pivot at 115.41 to below so the primary bearish market condition will be continuing, otherwise the price will be ranging within yearly Central Pivot and yearly S1;

Instrument S1 Pivot Yearly PP R1 Pivot USD/JPY 115.41 120.63 125.41

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks