The Signal And The Noise

by

, 06-27-2014 at 05:56 AM (1855 Views)

The Signal And The Noise

- Fed, investors have become complacent about inflation.

- Technical and cyclical forces are pushing consumer prices higher.

- Late in this bull market, Fed must beware of making a mistake.

U.S. Federal Reserve Chairwoman Janet Yellen's press conference last week came just hours after Consumer Price Index data revealed inflation of 2.1 percent year over year. Nevertheless, she was exceptionally dovish and sanguine on inflation. Yellen contended that even though the U.S. economy is near the Fed's objectives of full employment and price stability, recent data on inflation was "noise" and there continues to be considerable underutilization in the labor market. This was only the most recent demonstration of a willingness among Fed policymakers to highlight any number of economic data points to support accommodative monetary policy. It came even though labor conditions are improving toward a level associated with the non-accelerating inflation rate of unemployment (NAIRU); a tipping point of around 5.5 percent unemployment which has historically corresponded with a period of Fed tightening.

I am increasingly of the view that the Fed and investors are complacent about inflation. While a broad-based secular increase in inflation is most likely a problem for the next decade, there are a number of technical and cyclical forces working to push consumer prices higher. One technical factor is the one-time 2 percent Medicare payment cut which went into effect in 2013 and temporarily depressed healthcare costs for Medicare recipients. The recent increase in healthcare costs results largely from the year-over-year effects of this one-time cost reduction expiring.

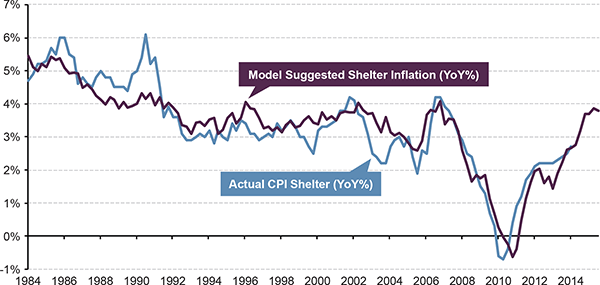

Another inflation factor at work is shelter. With rental vacancy rates hovering near 13-year lows and new home sales soaring by 18.6 percent to an annualized pace of 504,000 units in May, we can expect a continued rise in shelter costs for the rest of the year and possibly into early 2015. As a result of these technical issues and the cyclical factors associated with the economic expansion and employment growth gathering pace, we are likely to see inflationary pressures continuing to build. It is clear that we have now passed the days of low inflation growth.

We are in the late stages of a bull market and, as I have noted before, bull markets do not die of old age, but typically end as a result of a policy misstep. If Fed policymakers want to avoid such a mistake, they might start listening more closely to the "noise."

U.S. Shelter Inflation Likely Heading Higher

May's Consumer Price Index (CPI) data surprised to the upside, with transportation and medical costs adding to the 0.3 percent month-over-month gain in core CPI. However, the biggest contributor to increasing consumer prices continues to be shelter costs, which account for over 40 percent of core CPI (and 22 percent of core Personal Consumer Expenditures (PCE), the Federal Reserve's favored gauge of inflation). Shelter inflation measured by CPI is already up 2.9 percent from a year ago, and due to falling vacancy rates and gains in home prices, shelter costs could accelerate to nearly 4 percent growth over the next year, which would push core CPI well above 2 percent.

ACTUAL CPI SHELTER YEAR-OVER-YEAR PERCENT CHANGE VS. MODEL SUGGESTED SHELTER INFLATION

Email Blog Entry

Email Blog Entry