EUR is rising moderately. Overview for 22.04.2024

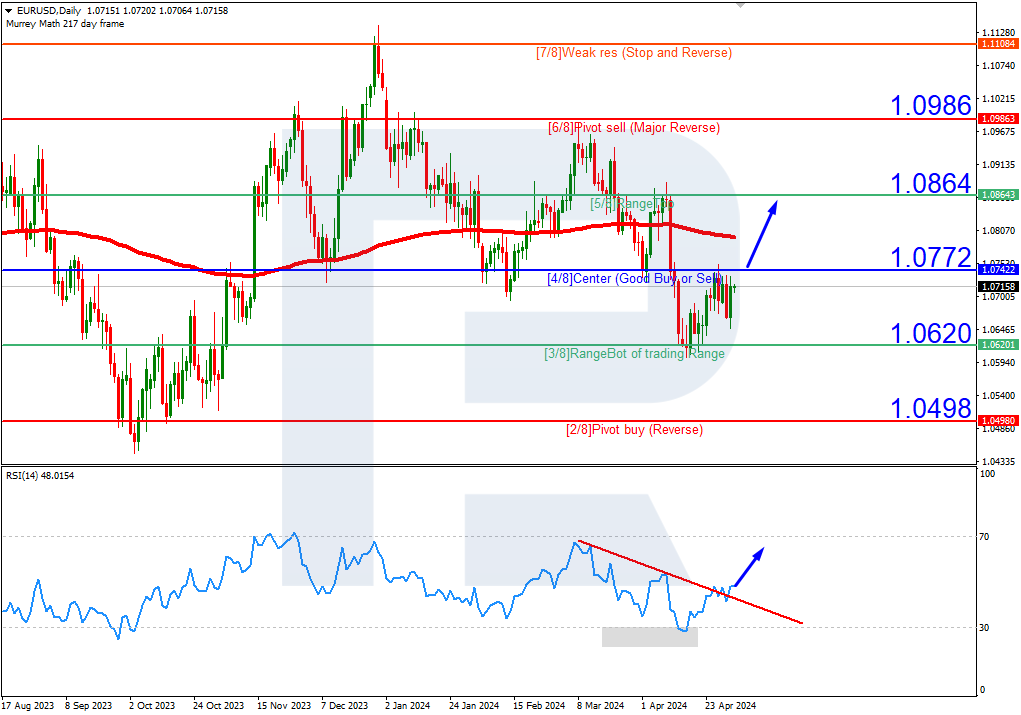

The primary currency pair maintains its upward trajectory on Monday. The current EURUSD exchange rate stands at 1.0663.

Recent comments from the US Federal Reserve have led investors to reconsider global interest rate cut timelines. Meanwhile, the European Central Bank is believed to start reducing the interest rate in the mid-year.

ECB member Madis Muller stated on Friday that the regulator may cut interest rates several times by the end of the year after the initial move in June if inflation is in line with expectations. ECB president Christine Lagarde hinted at the same last week without providing indications of specific timelines.

ECB official Robert Holzmann stated earlier that the ECB will likely need more time to be prepared to cut rates as aggressively as planned.

As usual, opinions differ, but this diversity of viewpoints proves positive: the market is concerned about prospects and, therefore, carefully analyses the developments.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks