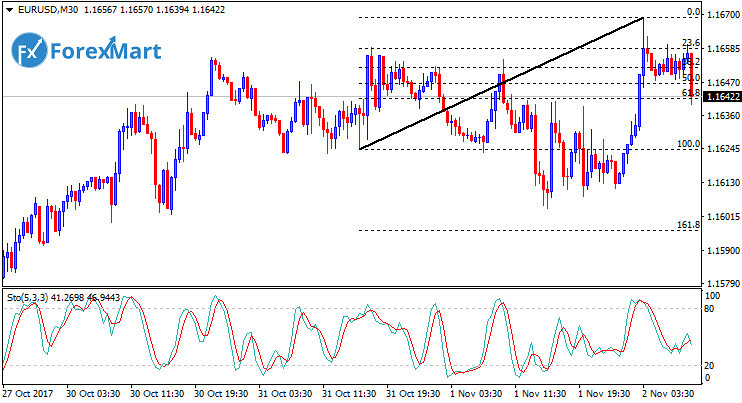

EUR/USD Fundamental Analysis: November 2, 2017

The EUR/USD pair waited for the FOMC minutes throughout the trading day on Wednesday, the minutes are expected to be issued during the American session. Aside from this pair, there are other many currency pairs that desire to know the thoughts of Fed members regarding the future rate hikes with expectations to help them determine the short-term trend for the U.S dollar.

This ensures that the single European currency was fixed in a very tight range at 30 pips, while markets in a long position understand that any choppy movement would lead to an unprofitable trade. Since the focus is centered on the positioning of trades prior the major news events coupled with large trends once the news was issued.

It became more interesting due to the subsequent news later this week which has equal of importance with concerns of the greens. It further opened the door for the possible reversal by the FOMC with the approaching news events.

The FOMC failed to achieve its target, however, most of the text remained unchanged, particularly the talks of future outlook that came in lower than market expectations. This resulted in a sudden minor shock for the USD, met some buying and pushed the bucks to a tight range until the end of the course after the minute's publication.

Considering all the projections formulated the entire day, the minutes conversely disappointed the markets which further triggered choppy data by means of the ADP report released earlier the day.

There are reports that confirmed Jerome Powell as the next head of the Fed Reserve but caused the dollar to weaken later this day, nevertheless, the effect of this news would likely be temporary.

Ultimately, the attention was turned towards the British pound as there are no releases from the United States or the European region for today. Hence, it is safe to say that there is some tight ranging and consolidation within the euro-dollar pair amid the trading day while waiting for the US employment statistics tomorrow which could roughly confirm the rate increase in December.

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks