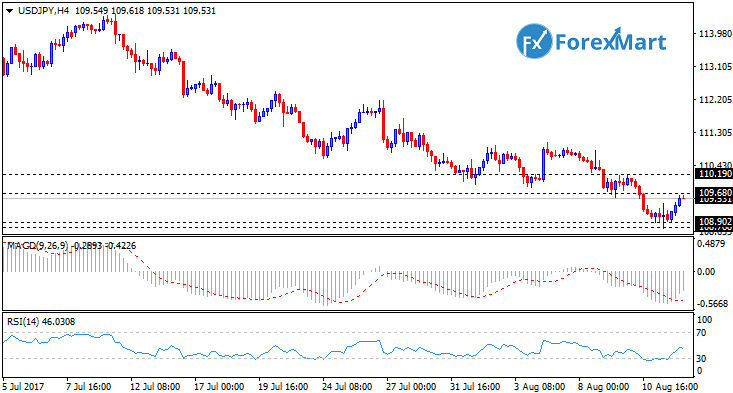

The U.S. dollar rebounded on Friday as it reached the 109 level which seems to be appealing to most traders. There is a high volatility for this currency pair with noises involved between North Korea and America. People are looking for safety currencies such as the Japanese yen to move forward.

There are various noises found at any moment which seems to persist. After some time, there will be more opportunities for long-term although sellers are predominantly taking over for short-term.

It is suggested to trade in small positions amid a highly volatile environment. However, if the price breaks higher than the 110 level which indicates the strengthening of the market that could reverse the trend and induce higher volume of purchases.

A pullback to the 105 level is possible since there is more support found in there. This would make trading more complicated and it is anticipated to have sudden fluctuations which could induce fear globally. Overall, volatility will be a big problem with the currency pair.

8Likes

8Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks