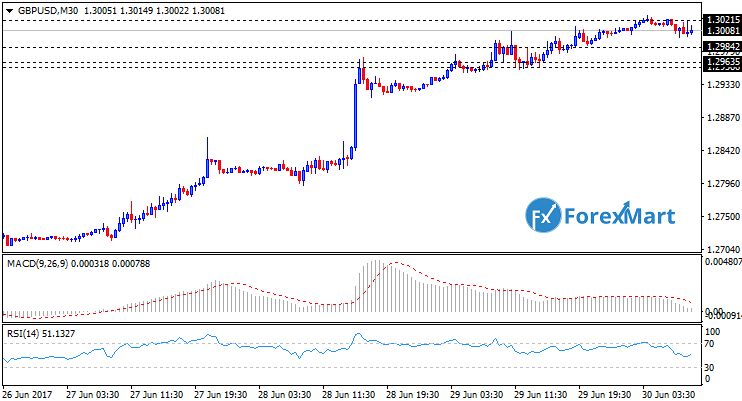

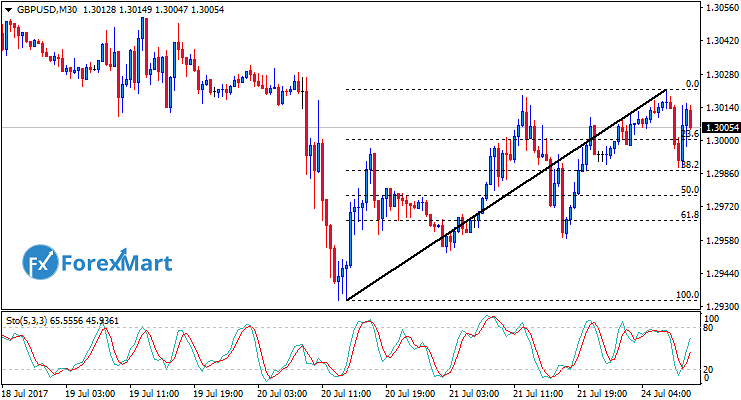

The British currency rallied amid Thursday trading session as it reached the 1.30 region. Upon breaking the mentioned area allows the market to lead over the top of 1.3450 in the longer-term.

In doing so, a series of pullback has to be done in the short-term and then, the market is expected to deal with a “buy on the dips” situation. It further requires a bit of cautiousness when purchasing with that high level, however, it does not necessary to sell but should imply more patience.

The Friday would likely to be a quiet session since the presence of volatility in the market is high in the past few trades. Currency markets should take a break at least once in awhile and we believe that this is the perfect timing to do so.

Furthermore, the Canadian and the US independence days are scheduled for the next days which is suspected of draining the liquidity on North America.

With this, there is a possibility that movements are very limited in the next 24 hours which could last until Wednesday next week. However, an upward bias is certainly expected since most market reflects this path.

The most suitable way to engage with this market is to search for the value from pullbacks or waiting for a breakout confirmation.

Headline risks are projected due to divorce proceedings which involve the countries, EU and U.S, nonetheless, the market seems favors the side of the sterling pound.

9Likes

9Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks