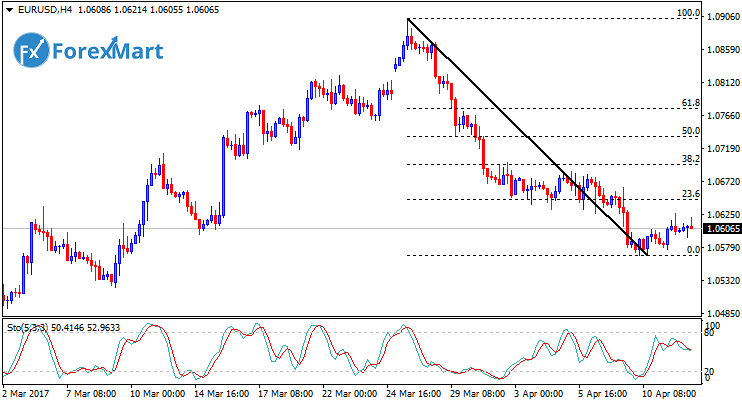

EUR/USD Fundamental Analysis: April 5, 2017

The EUR/USD pair is still trading within a very limited range, although the pair’s bulls have somewhat managed to maintain its hold on the currency pair in spite of the pair’s inability to move in any definite direction for quite a while now. The pair’s bulls were initially expected to surrender its gains in order to enable the EUR to advance towards 1.0500 points at least prior to the FOMC meeting, but so far this has not yet occurred and it is possible that the minutes will be released with the EUR/USD pair still trapped within its current trading range.

The market was taken by surprise yesterday as Fed member Lacker tendered his resignation after admitting that he had leaked top-secret information with regards to the 2012 FOMC meeting to a certain financial institution. Lacker has also stated that the firm’s analysts had the said information but regardless of Lacker’s manipulation of the said statement, it remains clear that he has illegally leaked confidential information and subsequently resigned when the said scheme was revealed. The USD had surprisingly no reaction to to this particular news once it was released.

However, during today’s session, the USD backtracked across the board as the EUR/USD pair surged from 1.0650 points and traded very near its range highs of 1.0680 points. As of the moment, the market is now in a consolidating move as a lot of economic data are expected to be released later today. The ADP Employment Change data will be released today, which is an important piece of economic news since this is largely considered as a basis for the result of the NFP report. The US Manufacturing PMI data will also be released, followed by the FOMC minutes towards the close of the NY session. A volatility surge is expected prior to the release of the FOMC minutes and as such, traders are advised to tread very carefully with regards to trading with the EUR/USD pair. The pair’s bulls are most likely to dominate the pair and could enable the EUR/USD pair to inch higher during today’s series of sessions.

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks