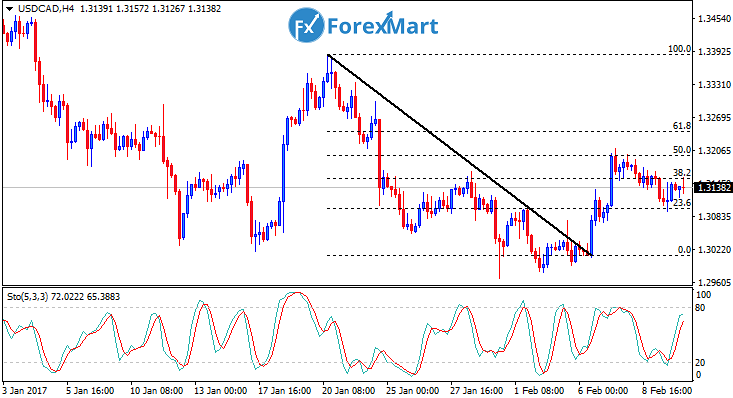

USD/CAD Technical Analysis: February 8, 2017

The decline in crude oil prices weighed on the Canadian dollar while the stronger US dollar added pressure to push the loonie downwards.

The USDCAD resumed a short-term uptrend on Tuesday. Moreover, the USD came in green against its Canadian peer. The spot gradually increased overnight reaching 1.3120 level prior to opening of the European session. There is a renewed buying pressure within the greens which supported the pair towards its fresh highs. The price spiked and touched 1.3190 region in the post-EU open.

The barrier restricted its developement as it holds the major enclosed the region. The price drove the 100 and 50-EMAs higher as shown in the 4-hour chart. The pair nearly reached the 200-EMA which became the resistance. Furthermore, the 50 and 100 EMAs shifted to an upward trend while 200-EMA headed lower. Resistance entered 1.3190 area, support holds 1.3120 handle.

The MACD approached the positive territory, preserving this area would mean a stronger stance for the buyers. RSI hovered around the overvalued range indicating another upward trajectory.

It is projected that a near-term bullish momentum will return. In order to resumed this bullishness, the pair should focus on top of 1.3190 mark.

9Likes

9Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks