The USD/CAD pair closed down the week on a much lower note as compared to the previous trading week after the Canadian dollar exhibited strength across the board and the USD weakened in value yet again even though it was able to recover during the latter part of the week. This particular recovery of the US dollar looks like it will be here for the long run, and this is why dollar bulls are putting added confidence to the performance of the US dollar in the next trading sessions. In addition, the Trump administration has already went about making changes and fulfilling its campaign promises, such as the shifts in Obamacare and the Mexican border wall, and the pulling out of US from trading agreements with Canada and other neighboring countries. This has created unrest in the market, and could open the doors for a possible trade war which is very bad news even for the US economy.

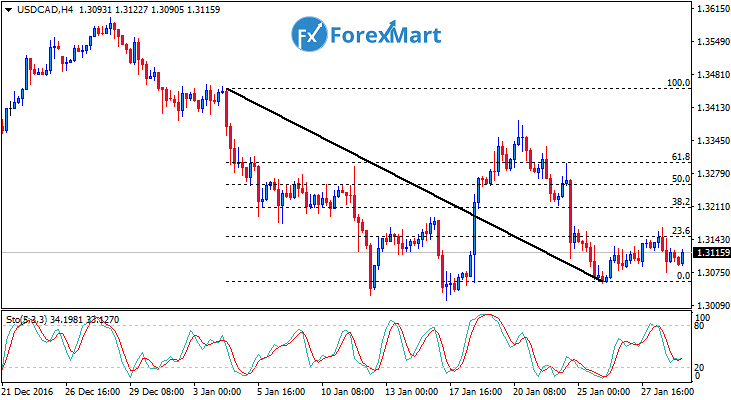

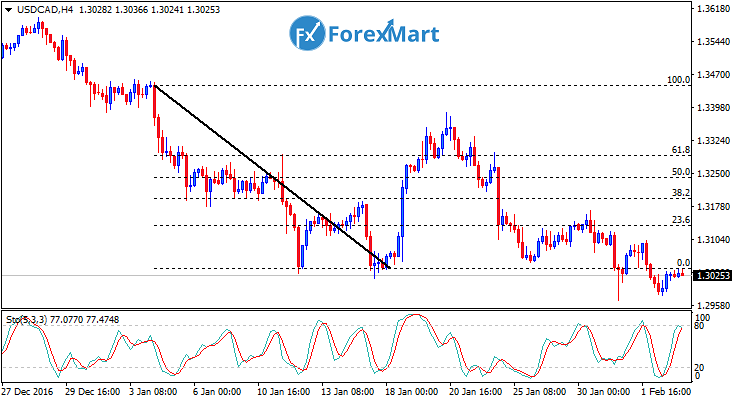

This has then prompted the USD/CAD pair to drop significantly in value from 1.3450 to 1.3000 points, but was saved by the sudden surge in the USD’s value as the previous week came to a close. The Canadian dollar also received support from the resiliency of oil prices, which managed to stay put in spite of the recent increase in the value of the US dollar. Market players are expecting this uptick in the USD/CAD to continue and could possibly extend up to 1.4000if it manages to stay just above 1.3000 points.

The Canadian GDP will be released this week, and governor Poloz from the Bank of Canada will also be releasing a statement this week. On the other hand, US will be releasing a string of important economic data including the NFP, wage earnings, as well as the statement from the FOMC. These are all expected to induce volatility in the market, and traders should either exercise caution or wait for things to settle before trading with this currency pair.

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks