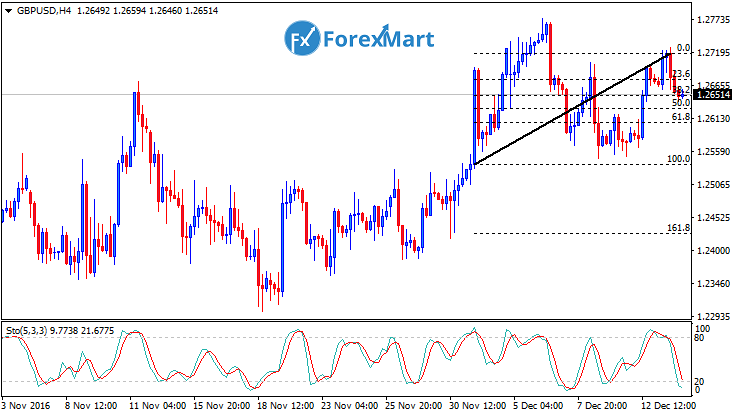

The Goods Trade Balance and Total Trade Balance established an optimistic data on Friday along with the strengthening of the sterling pound. The British currency procured some ground during the earlier trading session on Friday. Buyers drove the prices towards a higher position and tested the 1.2600 level amid the European session. The upward impetus short-lived consequent to the test, following the GBPís rollback below the level. As indicated in the 4-hour chart, the cable pair rebounded through the 50-EMA. Moving averages uphold its bullish bias.

Resistance lies in the 1.2600 are, the support sits at the 1.2500 region. The MACD histogram pierced through the negative range. When the MACD stayed in the negative zone, sellers will obtain more strength. The RSI is within the neutral territory.

The GBPUSD is expected to weaken upon the break below the 1.2600 level. Likewise, this could lead the prices towards 1.2500.

9Likes

9Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks