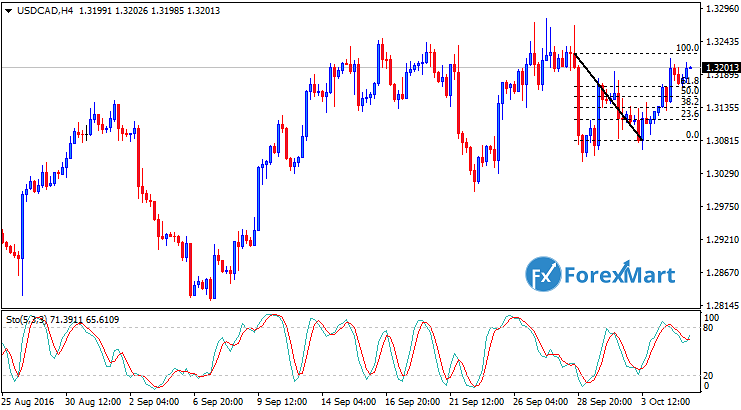

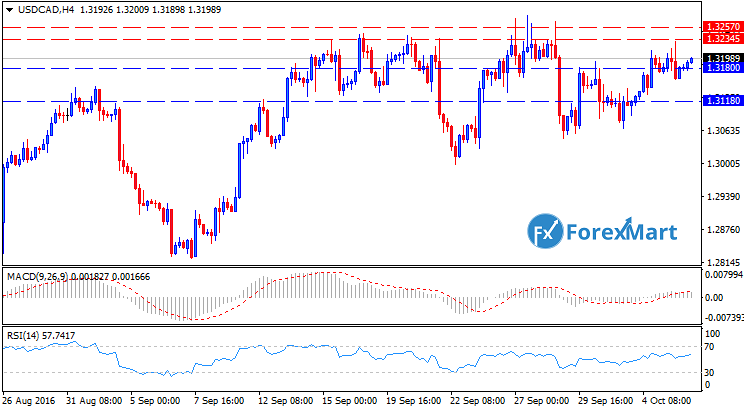

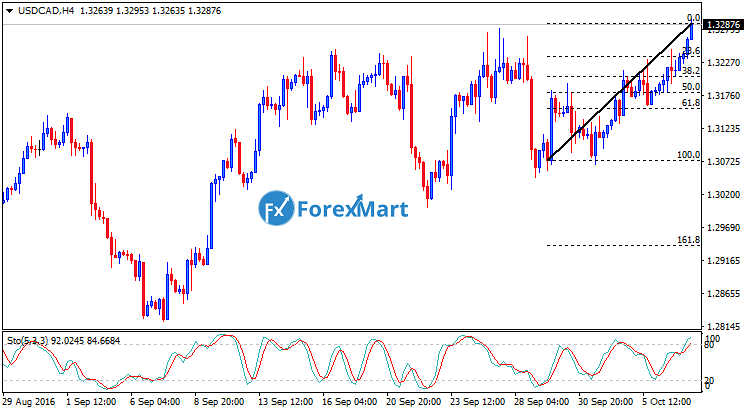

The recent increase in value of the USD has caused certain currency pairs like the USD/CAD to move forward with their bullish runs, a move that has long since been anticipated for the currency pair during the past week. The USD/CAD pair was able to push through its resistance levels at 1.3140 points, even going beyond 1.3170 where it was met with marginal resistance and went with support levels after a gain of 1.3140 points.

The Canadian and US trading sessions saw the USD increase its value by a significant margin and has caused the USD/CAD to go through the 1.3200 trading range, and market players are expecting that the pair will be able to reach its short-term targets at 1.3240 and 1.3280 with relative ease in just a few days. The currency pair is now at the support level of 1.3173 but is still expected to go above its present trading range.

Market players are now awaiting the release of the Canadian trade balance data and the ADP Non-Farm Employment data from the US. These economic data should give traders an idea of the relative strength of the two economies, as well as the possible impact of lowered oil prices on both countries. This could then lead to an increased volatility towards the end of the next trading session.

9Likes

9Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks