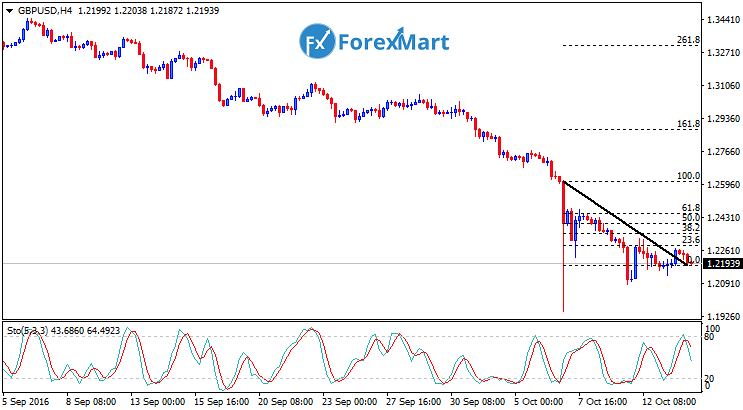

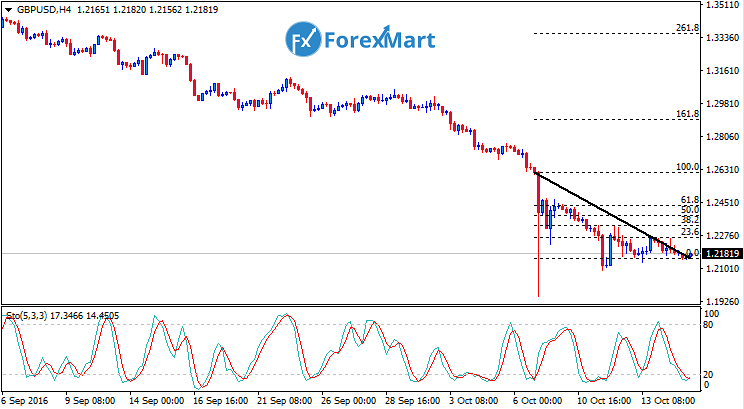

The GBP/USD pair had a stagnant run during the last trading session after the sudden drop in its value last week. The pair had an average day-to-day range of a minimum of 200 pips. The currency pair is now consolidating between 1.2130 and 1.2550 points, with a possible break in the resistance level of 1.2550 opening the way for the pair to reach 1.2360, allowing the pair to have selling opportunities. The currency pair is now trading within the 1.2557 range and analysts are awaiting whether the pair would break through resistance or come down at the support level.

The GBP/USD continues to be affected by the Brexit, and analysts are speculating the pair will continue resonating its effects for another two years, or until such time that the UK finally completes the referendum.

Market players are now waiting for an announcement from the Bank of England’s Governor Carney, as well as a statement from the Federal Reserve’s Janet Yellen and the release of the retail sales data later today. Expect an increased volatility for the pair at the close of today’s trading session. Analysts are generally throwing caution to the wind with regards to transacting with this particular currency pair, especially due to the Brexit and the recent drop in the Chinese economy.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks