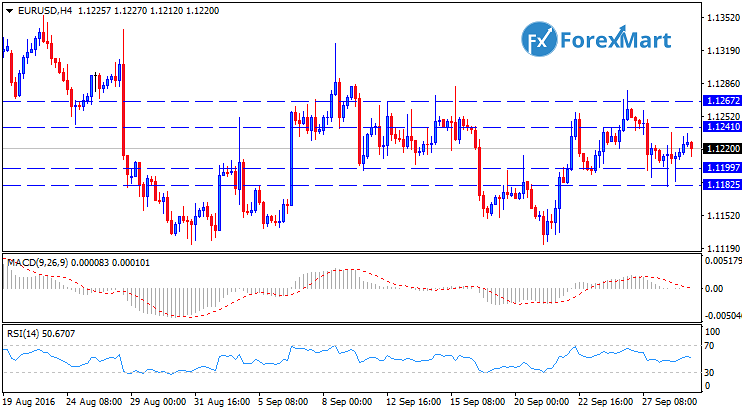

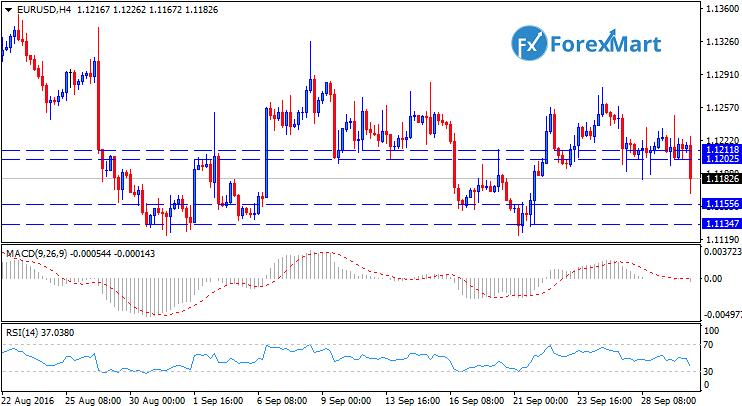

The EUR/USD pair dropped to 1.190 points during Tuesday’s session as the USD increased its trading value during the session but later lost some of its gains as Fed’s Fischer released a statement saying that as much as he does not want to have low interest rates, he wouldn’t want it to increase as much. However, Fischer also noted that he has no information with regards to the date of the expected interest rate hike from Fed. The last trading session exhibited active volatility levels, especially with Hillary Clinton’s impressive performance during the first US Presidential Debate. However, the dropping bank equities in London’s trading session affected the trades on Tuesday.

The USD also increased due to the added intraday support from highly positive macroeconomic releases, particularly with the improved Conference BC Confidence Index which is now at 104.1 from last month’s 101.8. The expansion rate of business activities also increased after a three-month dormancy, according to preliminary Markit Services and Composite PMI data. Services PMI went up to 51.9 in September as compared to August’s 51.0, while Composite PMI data also increased to 52.0 points from last month’s 51.5 points.

The EUR/USD is still primarily in the negative territory, albeit with a persistence neutral stance. The 4-hour chart for the currency pair has no clear indicators, with prices recovering after a slew of horizontal moving averages and technical indicators going above the middle range.

9Likes

9Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks