Forex Analysis & Reviews: Forecast for USD/JPY on January 18, 2024

USD/JPY

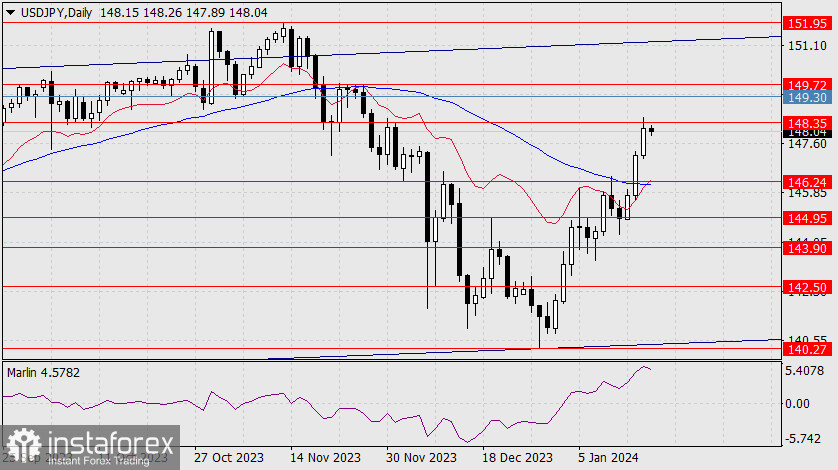

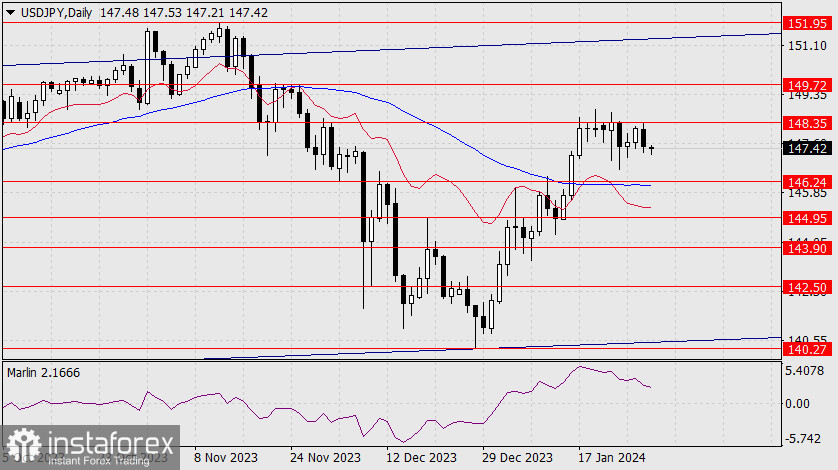

The pair demonstrated strong growth in the past three days and even reached the target level of 148.35 yesterday. At this point, the Marlin oscillator on the daily chart indicated a reversal.

It remains uncertain whether the pair will fall into a correction or a medium-term decline. Nevertheless, growth will halt at 149.30 (price channel line on the weekly chart) and 149.72 (target level determined by the peaks of November 22-24). In the case of a correction, the pair will find support at the MACD line and the level of 146.24. Consolidation below this level will lead to a decline towards the target levels indicated on the chart.

On the four-hour chart, the Marlin oscillator shows the beginning of a reversal, while the MACD line, which the price must overcome to confirm its intention, remains downward. The decline of the pair will not be rapid (in the form of a triangle), and this will allow the MACD line to approach the price.

Analysis are provided by InstaForex.

Read More

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks