Forex Analysis & Reviews: Forecast for EUR/USD on October 15, 2021

EUR/USD

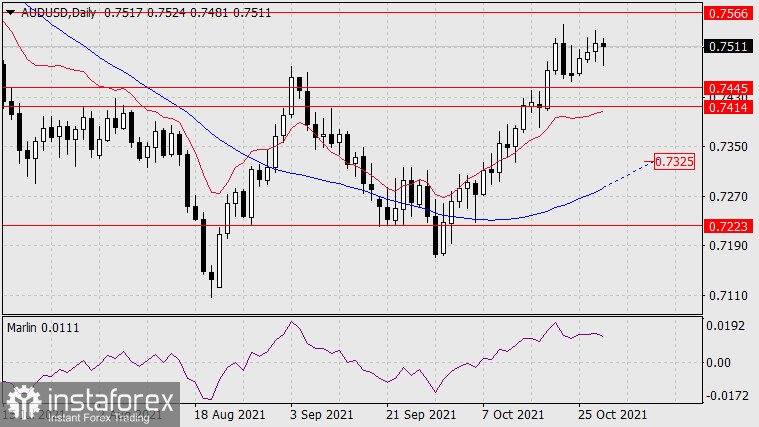

Yesterday, the euro closed the day with a symbolic growth of 1 point, the peak growth was 30 points, so yesterday can be considered corrective. US retail sales data for September are due tonight, forecast at -0.3%. In the euro area, an increase in the trade balance for August is expected from 13.4 billion euros to 15.3 billion. The euro will likely rise. The growth target is the MACD line in the 1.1668 area.

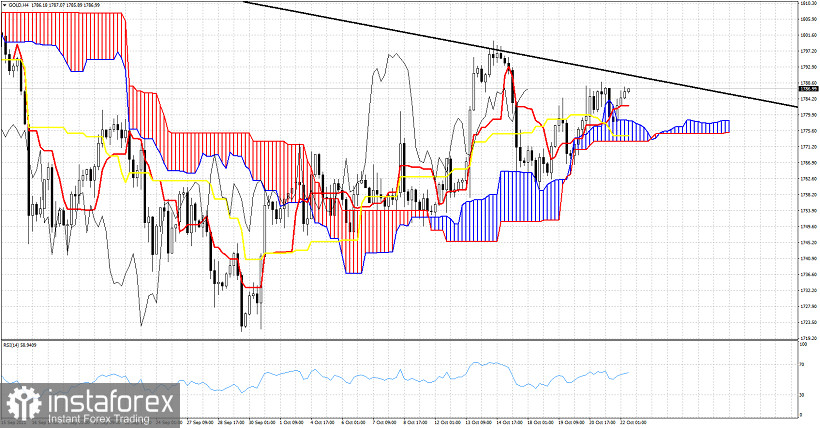

On the four-hour scale, the Marlin Oscillator was discharged from the overbought zone yesterday, now it is ready to continue rising. The correction developed above the balance indicator line, which means that investors are still interested in buying.

Analysis are provided byInstaForex.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks