Forex Analysis & Reviews: Forecast for EUR/USD on December 22, 2020

EUR/USD

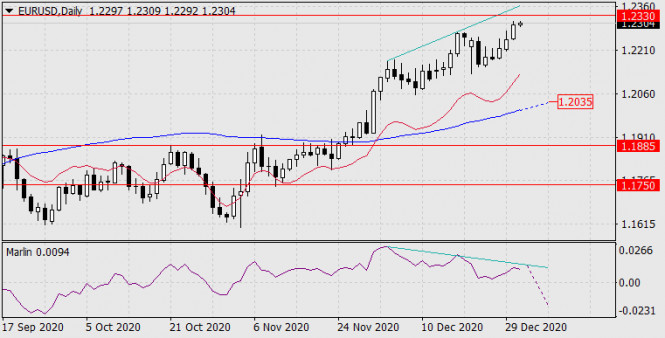

The euro fell by 126 points on Monday and by the end of the day it practically won back the entire fall. The fall was bought out in large volumes by the largest players in order to avoid an uncontrolled collapse. All this happened on the news about the readiness of British Prime Minister Boris Johnson to back down in the fishing dispute with the EU, setting the quota at 66% of the current volume.

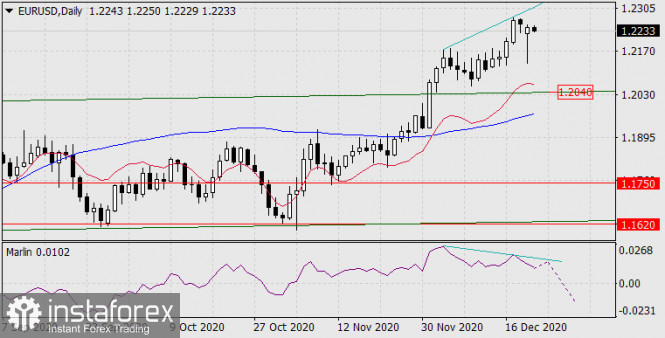

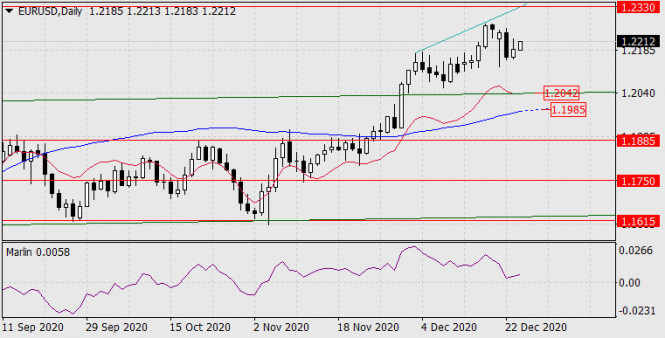

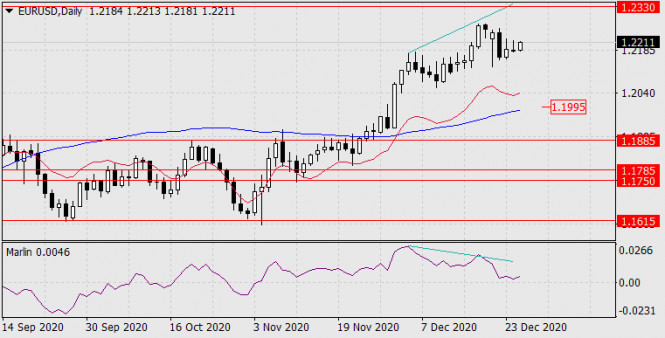

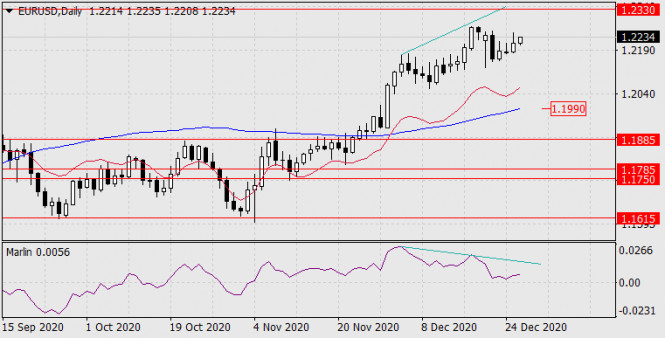

The daily chart shows that the reversal divergence of the price and the oscillator remains. Marlin continued to move down, trying to get out of the growth zone. The downside target at 1.2040 that was formed by the price channel line is still present. However, there is a possibility of forming a double divergence. At the same time, the price will try to rush to the target level of 1.2330 and only then will it reverse into a medium-term decline.

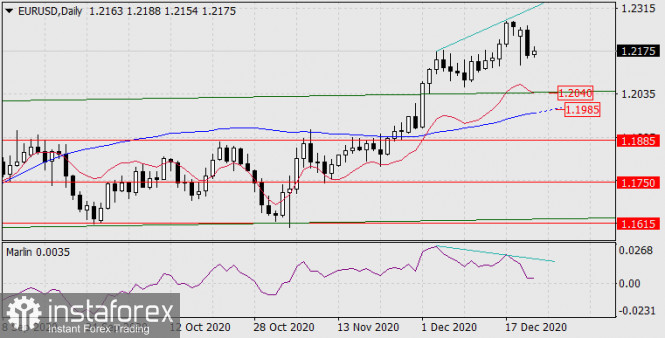

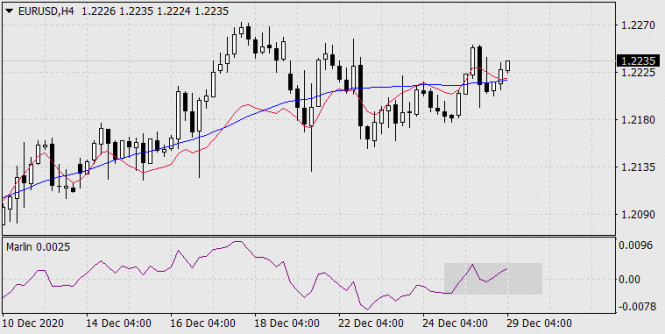

The four-hour chart shows that the price fell below the MACD line, then went back above it, and is currently preparing to move below it. Also, the Marlin oscillator, after the signal line went into the negative area, returned to the growth area and intends to fall again. The condition for accomplishing this move is for the price to fall below the MACD line, under 1.2205. If this condition is not met, then the double divergence option is implemented.

Analysis are provided byInstaForex.

5Likes

5Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks