Forecast for AUD/USD on November 24, 2020

AUD/USD

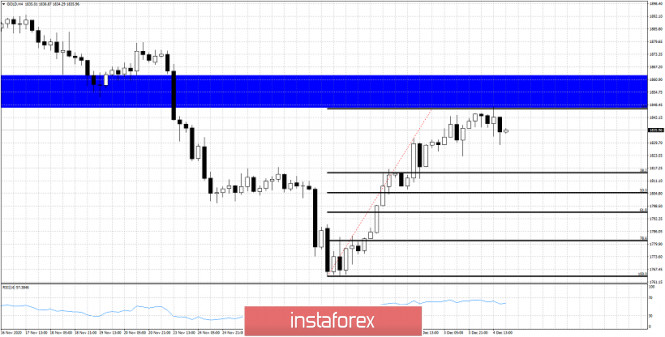

The Australian dollar lost 15 points under the overall optimistic pressure of the US dollar on Monday. But while the Australian currency is in no hurry to leave the range of the last six trading sessions, it needs to make sure that the market intends to further strengthen the US currency. During this waiting time, even if it does not work out the upper target of 0.7380, AUD/USD can form a double divergence with the Marlin oscillator. The most important economic data for Australia will only be available next week, such as Quarter 3 GDP, trade balance, PMI, and construction. Since the RBA meeting will take place on Tuesday, December 1, the "kangaroo" can feel quite free until the end of the week.

On the four-hour chart, the price consolidated under the MACD indicator line, the Marlin oscillator briefly went into the negative zone, and this morning it is trying to get back into the growth zone. Neutrality is also observed here on the four-hour scale. It still waits for the price to fall below the level of 0.7260, which is under the daily MACD line.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks