Forecast for EUR/USD on August 17, 2020

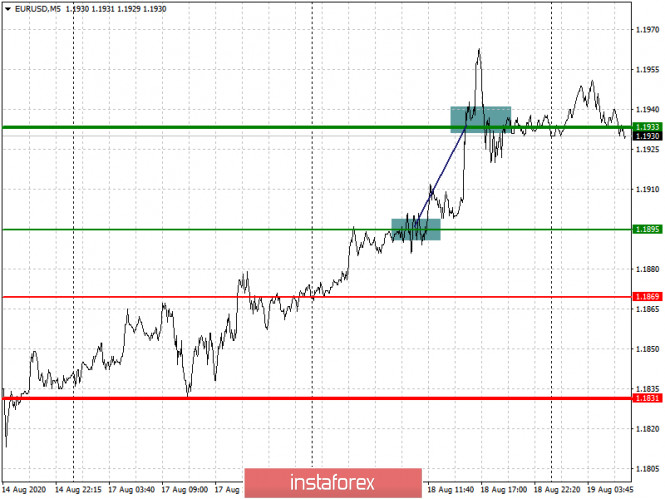

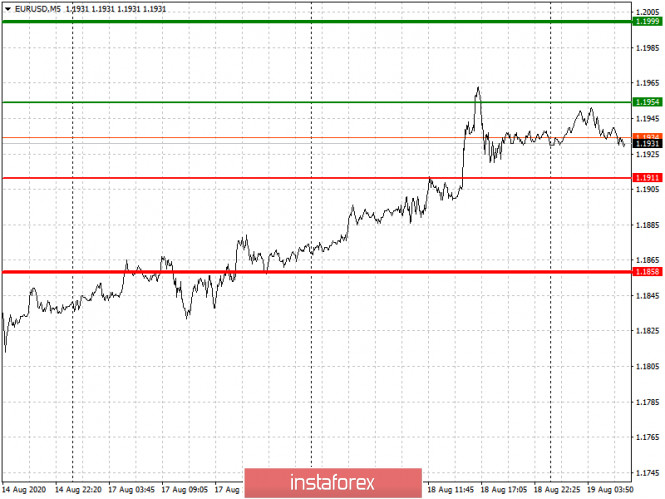

EUR/USD The euro continued to develop in the uncertain range of 1.1712-1.1903 on Friday. The euro will continue to increase if the price goes above the upper limit of the price channel at 1.1903, and in this case, the target range will be 1.2040/55. Historically, the range corresponds to the low of July 2012. The price reaching the specified range can also mean that a double diverenge on the Marlin oscillator can form. That is, the euro growing by two figures will not cancel the main scenario of a currency reversal in the medium and long term.

The price falling below the lower border of the range will mean that it is out of the free roaming zone and the first target will be the level of 1.1620, then 1.1490. The price divergence with the Marlin oscillator will increase, the signal line will enter the zone of negative values, and this will lead to an accelerated fall in the euro.

The price consolidated above the MACD indicator line on the four-hour chart, Marlin is also in the growth zone, which together maintains an increased probability of growth to 1.1903. Nevertheless, since the price is in the free roaming zone, it can once again go under this line, as it was on August 13-14. We are waiting for the development of events.

Analysis are provided byInstaForex.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks