Gold price 'to average $1,220 in 2014'

Some analysts expect price to fall below $1,000, while others are much more bullish

=============

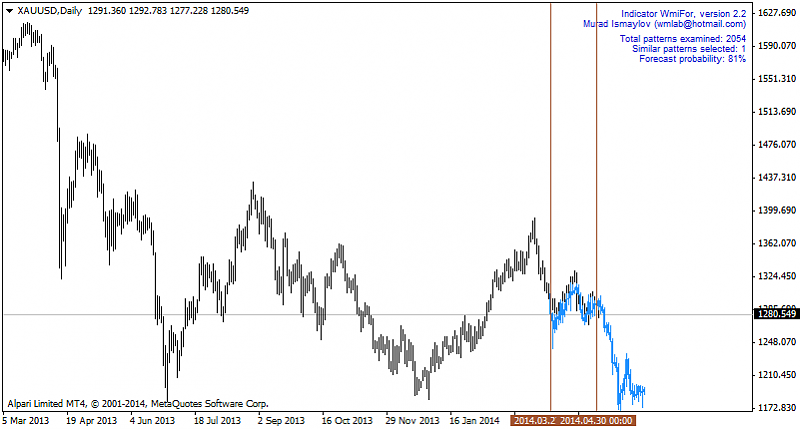

The gold price will average $1,219 an ounce this year, according to a survey of analysts.

The analysts expect the gold price to range between $1,067 and $1,379 this year, a report compiled by the London Bullion Market Association (LBMA) found.

Yesterday's gold price according to the LBMA's afternoon London "fixing" was $1,248.

Gold ended 2013 at $1,202, 28pc lower than at the beginning of the year, bringing to an end 12 consecutive years of price growth.

The most optimistic prediction for the gold price this year came from Martin Murenbeeld of Dundee Capital Markets in Canada, who said the price could go as high as $1,550, although he put the bottom of its possible price range at just $1,075.

"With every central bank in developed economies hoping to boost inflation, there is sufficient room to speculate that the gold market will make a turn in 2014 and end the year higher than where it started," Mr Murenbeeld said. But he added: "The US dollar is likely to remain a headwind for gold in 2014."

Gold often moves in the opposite direction to the US currency, which is expected to strengthen as the Federal Reserve slows its money-printing policy of QE.

At the other end of the scale, three analysts said the price could fall as low as $950. One, Robin Bhar of Société Générale in London, said gold investors were "likely to remain big net sellers over the coming months and quarters".

The analysts who contributed to the report cited the possible strengthening in the US dollar, the reining in of QE, weak global inflationary pressures, oversupply of gold and further sales by investors who hold gold in exchange-traded funds or ETFs as factors that could restrain gold prices.

"But the price could be supported by continued strong demand from China, a relaxation in India’s import duties as well as the prospect that low prices could constrain mine output and supply of scrap," the report added. "So an increase in price cannot be ruled out particularly if such “positive” influences take centre stage."

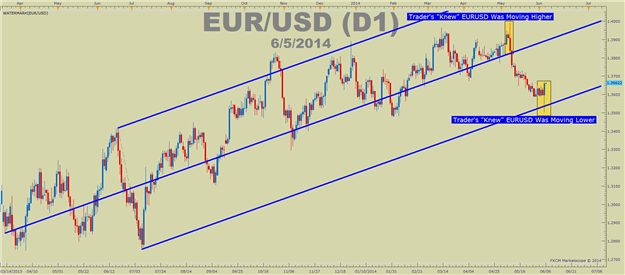

Investors should treat the forecasts with caution, however – the predictions about last year's gold price were far too optimistic. The average analyst's prediction for the gold price in 2013 was $1,753, but the average actual price last year was just $1,411 – almost 20pc lower.

Separately, analysts at Morgan Stanley cut their gold price forecasts for 2014 by 12pc to $1,160.

People who invested in gold via funds suffered big losses last year. The popular BlackRock Gold & General and Way Charteris Gold Portfolio Elite funds lost half of savers’ money, while the Junior Gold fund declined by 65pc – the worst performance of the 1,500 funds available to British savers.

HOW TO INVEST IN GOLD

Gold Bars

Bars come in metric sizes, and are based directly on that day's gold price, plus a premium for manufacture and marketing. The smaller the bar, the bigger the premium.

Gold coins

Twenty-two carat gold sovereigns the favourite of British investors. Sovereigns dating from about 1887 and up to 1982 are currently considered the best investment. Bullion coins recognised as UK legal tender are exempt from capital gains tax.

Another coin option is to buy South African Krugerrands. The smallest is a 0.1oz coin, which costs about £125 at the time of writing.

The specialist website MoneyWeek has a directory of bar and coin dealers.

Exchange-traded funds

ETFs are funds, traded on a stock exchange like shares, that allow investors to track the performance of particular indices or a commodity, providing the investor with the same returns as this underlying market.

ETFs are available for gold, silver, platinum and palladium. ETFs can be traded daily – all you pay is the dealing charge of around 0.4pc, or £7 per trade. ETFs are increasingly the most popular method of gold investment.

Some hold physical gold while others depend on financial instruments such as derivatives. The former, seen as safer, are offered by companies such as iShares and EFT Securities.

Gold accounts

Gold bullion banks offer two types of gold account – allocated and unallocated. An allocated account is effectively like keeping gold in a safety deposit box and is the most secure form of investment in physical gold. The gold is stored in a vault owned and managed by a recognised bullion dealer or depository.

With an unallocated account, on the other hand, investors do not have specific bars allotted to them. Traditionally, one advantage of unallocated accounts has been the absence of storage or insurance charges, because the bank reserves the right to lease the gold out.

Shares and funds

You can of course buy individual shares of companies that either trade or mine gold. Several funds, such as BlackRock Gold & General, aim to pick the best of these shares.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks