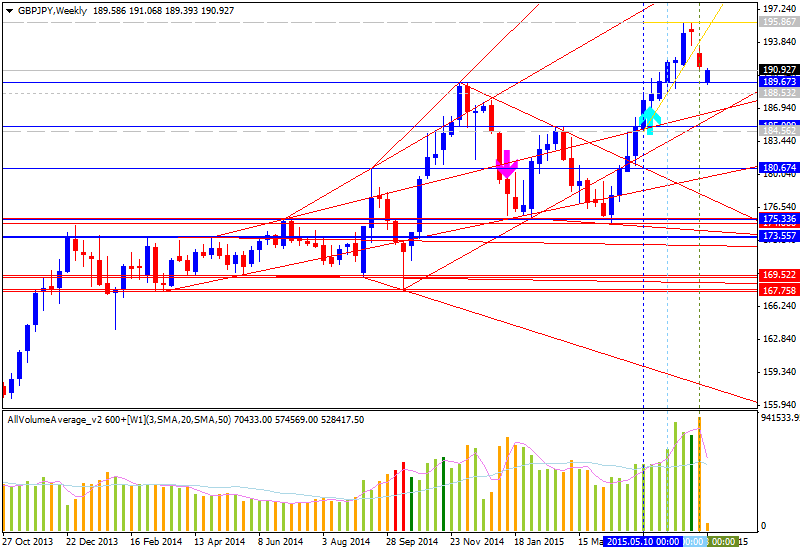

The 1.55 area was supportive in the past, but during last week the pair broke it down. I can assume that the trend of this marked changed completely. I don't expect it to go up in the near future and believe that for a long-term trading I'd better choose selling here...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks