Why The Market Has Got It All Wrong And Why I'm Doubling Down Into The Alibaba IPO

by

, 07-22-2014 at 03:10 AM (1505 Views)

Why The Market Has Got It All Wrong And Why I'm Doubling Down Into The Alibaba IPO

- The selloff in Yahoo post poor earnings is a typical example of Mr. Market's short-sightedness.

- Given already implied bargain-basement valuations, the current move implies Yahoo core business lost ~90% of its value overnight.

- The renegotiation of the Alibaba stock sale alone adds $1.5 per share to the SOTP case.

- With worst case now more than priced into the stock, YHOO looks a very asymmetric risk/reward on the long side.

As predominantly a value/special-situations investor, I am always looking for asymmetric risk/reward opportunities: I try to invest in situations where even if something goes badly wrong, the valuations are such that I should do OK; and if just one or two things go right, you can see significant upside. It was in this vein that I originally invested in Yahoo (NASDAQ:YHOO), a decision that clearly cost me today with the stock off 5%, or ~$1.7, on pretty poor 2Q earnings.

However, this is one of those occasions where I think Mr. Market (along with a ton of short-sighted analysts) can't see the forest for the trees: not only were there nuggets of meaningful good news in the earnings release, but the implied valuation of the core business is, I believe, so beaten down it implies it won't exist in a couple of years. Let's look at why.

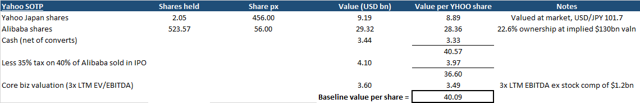

SOTP pre-earnings: YHOO core only worth $3-4 per share

As a quick refresher, here is my SOTP analysis, pre-earnings release. As you can see I only accorded $3.6bn EV to the core business (assuming 3x LTM EBITDA ex stock comp of $1.2bn), and also that YHOO would sell 40% of their Alibaba holding at $130bn implied valuation, paying tax at a 35% rate. The key conservative assumption, here, is that the rest of Alibaba stays at $130bn post IPO (too low given this is where the company priced stock options for insiders this month). Nevertheless, I get a base case value of $40/share:

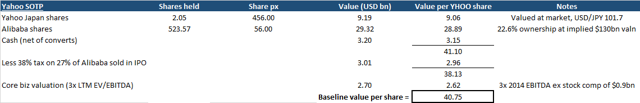

Post-earnings release adjustments

To update the SOTP for the earnings, we need to adjust the following:

- reduce share count (from 1.034bn to 1.015bn) for share buybacks

- reduce net cash balance (from 3.44bn to 3.2bn)

- reduce/adjust EBITDA for core business (I reduced from $1.2bn to $0.9bn ex stock comp, looking out to end 2014 fiscal)

- lower % of Alibaba stake sold from 40% to 27%; and increase tax rate to 38% (likely to be fully taxed)

Adjusting for these updates, here is what the base-case SOTP looks like (again, assuming $130bn for Alibaba):

As you can see, the implied valuation actually goes up ~70c per share, though the stock is down $1.8 as I type. The reduction in sale of the Alibaba stake - even assuming it occurs at $130bn, which I think is not going to happen - is worth a full $1.5 per YHOO share, despite the full taxation on that sale. Meanwhile the reduction in core business value cuts the SOTP by ~85c per share. Ironically, the after hours initial reaction saw the stock spike ~$1, perhaps in recognition of this, before the bearish sentiment took over.

So, what is going on?

Watching CNBC today, there is endless talk of how the core business is broken; how growth is not materializing; how ad rates are falling and penetration with key advertisers will take more time. What no one seems to mention in this sea of negativity, however, is that the core business - even at below-market, priced-for-failure levels - is barely 7-8% of the current price.

Thinking about it another way: I thought the core business was worth ~$3.6 per share pre earnings.

The Alibaba news added - conservatively - $1.5 per share to the valuation, while the lower cash balance cut ~20c from the overall valuation. So let's say the 'ex-core' value is $1.3 per share higher than where we thought it was pre earnings. However, the stock is $1.8 lower today - effectively telling us the core business valuation went from $3.6 per share to $0.3 per share because of this quarter!

This is a business that still generated ~$850mm in free cash flow last year and despite the poor performance should generate ~$750mm+ this year too. At $2.7bn EV for the core, that's an EV/FCF of 3.5x (~29% free cash flow yield). To put this into context, AOL trades at ~10.3x (as well as 6x EV/EBITDA, vs. 3x for YHOO). Frankly, 30% FCF yield is the kind of valuation you see for structurally impaired businesses drowning in debt (where the shareholders, or managers, have no claim on the free cash - otherwise the stock would be bought back). It implies the entire enterprise could be repaid in 3.5yrs - suggesting the business would have to disappear at that point to justify this valuation.

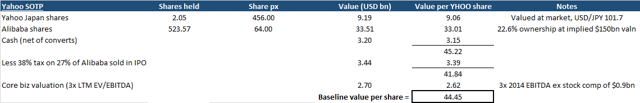

What happens if Alibaba prices at $150bn?

Let's say Alibaba prices at $150bn - this seems to be a number most are looking at, and is not really expensive (about 25x my estimate for 2015 earnings). Certainly, it is much cheaper than other high growth stocks like FB, JD, JMEI, etc, for a business with superior margin profile, market position, etc. Personally, I think even if it prices here it will trade higher, but, in any case, here is what re-running the SOTP looks like:

Under these still (I feel) fairly conservative assumptions, the SOTP suggests a valuation of $44.5 per share. Even allowing for a substantial conglomerate discount of say 10-15% (which I don't think is fully deserved, given how other companies involved in Alibaba trade, like Softbank), you still get a valuation $4-6 per share north of the current price.

Conclusion

Hence, this is the quintessential asymmetric risk/reward trade to me: even if we assume a below-market, priced-for-destruction multiple for the core business; an absolute bear case for the Alibaba IPO pricing; and a substantial conglomerate discount, it's hard to see how Yahoo is worth less than $34-35 per share. And that means if only one or two things go right - a higher Alibaba pricing, or a rally in BABA stock post listing; some improvement in the core; an acquisition of a 'growth' business; or maybe some activism emerging - you should do well from here.

Email Blog Entry

Email Blog Entry