Fibonacci Retracements Analysis 03.09.2019 (EURUSD, USDJPY)

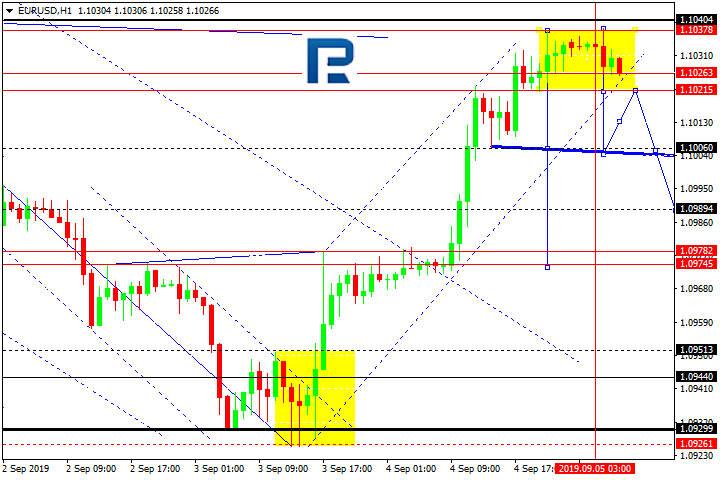

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, after finishing the short-term pullback, EURUSD is forming a new descending impulse. It seems as if the previous low at 1.1027 couldn’t provide enough resistance to bears and now acts as the resistance for bulls. After breaking the previous low, the instrument continue falling towards the post-correctional extension area between 138.2% and 161.8% fibo at 1.0942 and 1.0889 respectively.

Read more - Fibonacci Retracements Analysis EURUSD, USDJPY

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks