Gold (XAUUSD) is correcting after reaching a new all-time high

Gold prices are declining after reaching an all-time high of 2,483 USD per troy ounce.

Gold failed to hold near the all-time high of 2,483 USD reached last week. Buyers appear to have decided to lock in profits, causing XAUUSD quotes to reverse direction and fall below the 2,400 level.

The decline in gold prices is driven by the current strengthening of the US dollar against major currencies. An escalation of geopolitical tensions in the Middle East may provide support for gold.

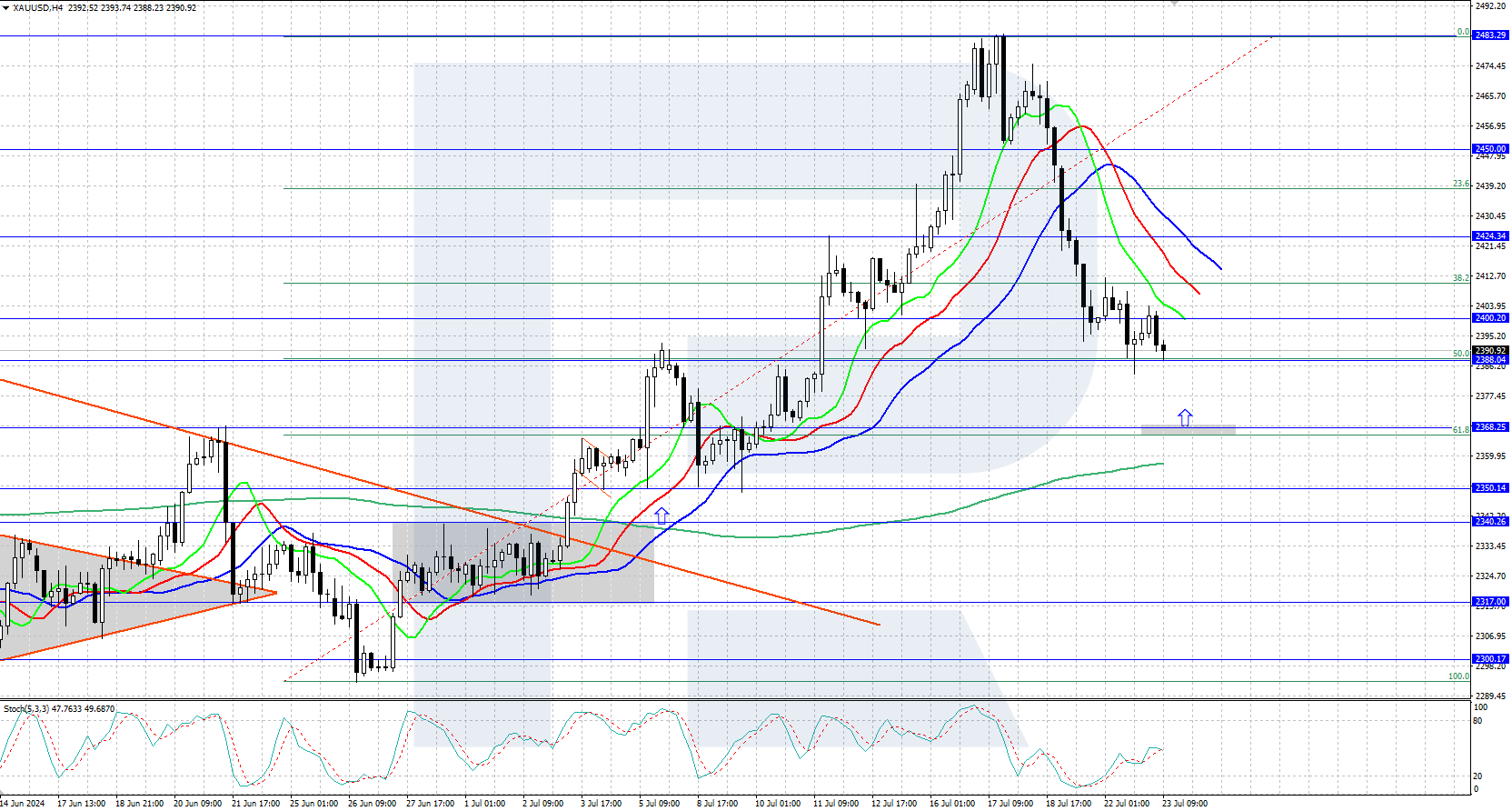

XAUUSD technical analysis

The XAUUSD H4 chart shows an ongoing downward correction from the historical maximum of 2,483 USD. The quotes are currently hovering around 2,388, which coincides with the 50.0% Fibonacci retracement level from the previous upward movement.

If bears gain a foothold below 2,388, XAUUSD quotes can be expected to fall further to the 2,368 support level, which coincides with the 61.8% Fibonacci retracement level. At this level, bulls might attempt a counterattack to reverse the trend upward.

Gold is declining in a downward correction after reaching the historical high of 2,483 last week. Bulls may attempt to reverse the price trend upward at 2,368-2,388 support levels.

Read more - XAUUSD

Attention!

Forecasts presented in this section only reflect the authorís private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks