AUD rises to a two-week peak, supported by several factors

The AUDUSD pair benefits from the RBA’s tough stance, the US dollar’s weakness, and attacks on the yen.

The Australian dollar has reached a two-week high against the US dollar and is hovering near the 0.6660 mark.

The main support for the Aussie came from the Reserve Bank of Australia, which maintains a hawkish stance on monetary policy. The RBA is expected to lower the interest rate much later than other major central banks.

Thus, the markets missed nearly every chance of an interest rate cut from the RBA in 2024. Overall easing is only projected to happen by the end of 2025, with an average expectation of 43 basis points.

RBA Governor Michele Bullock said that the regulator discussed the need for an interest rate hike at its June meeting without even considering a rate reduction.

The AUD rate is currently benefitting from short attacks on the JPY and the local weakening of the US dollar rate.

Later this week, the market will focus on Australia’s inflation data.

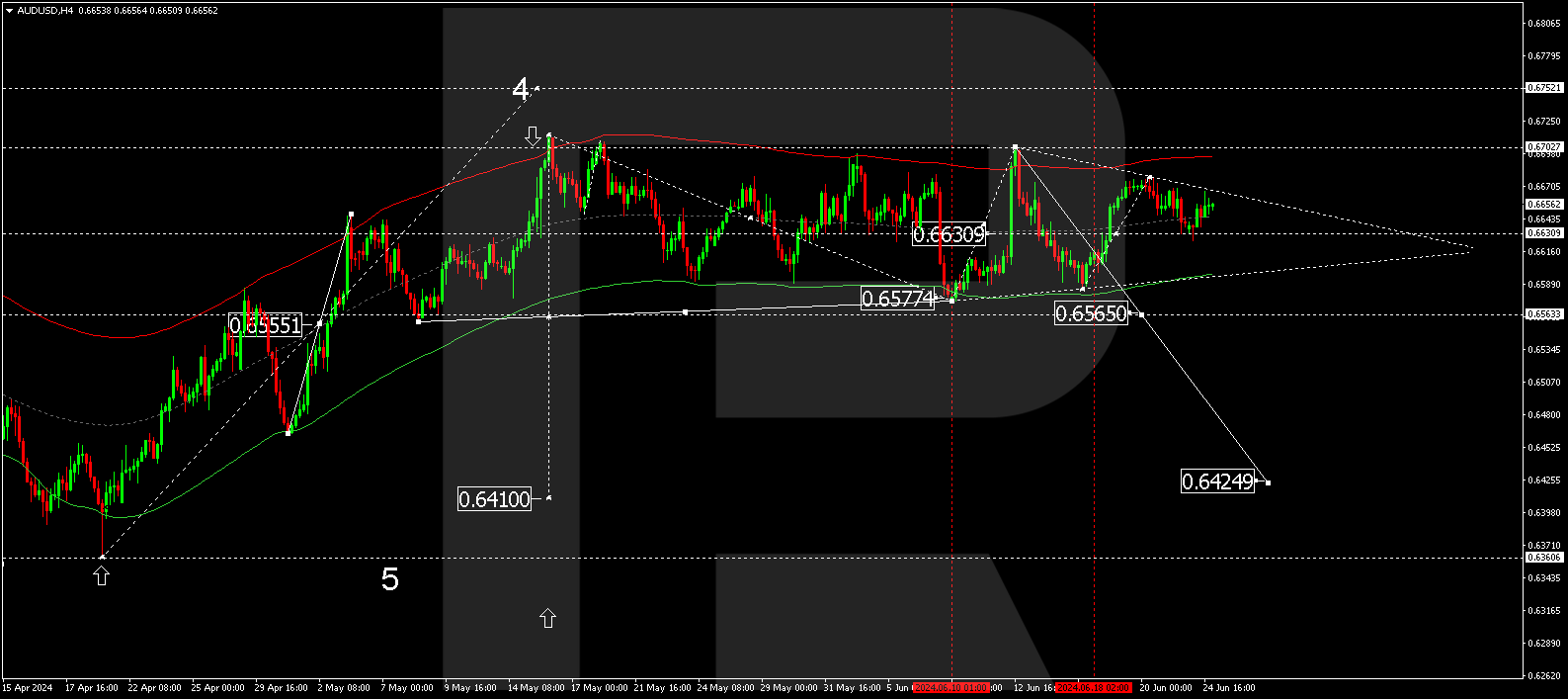

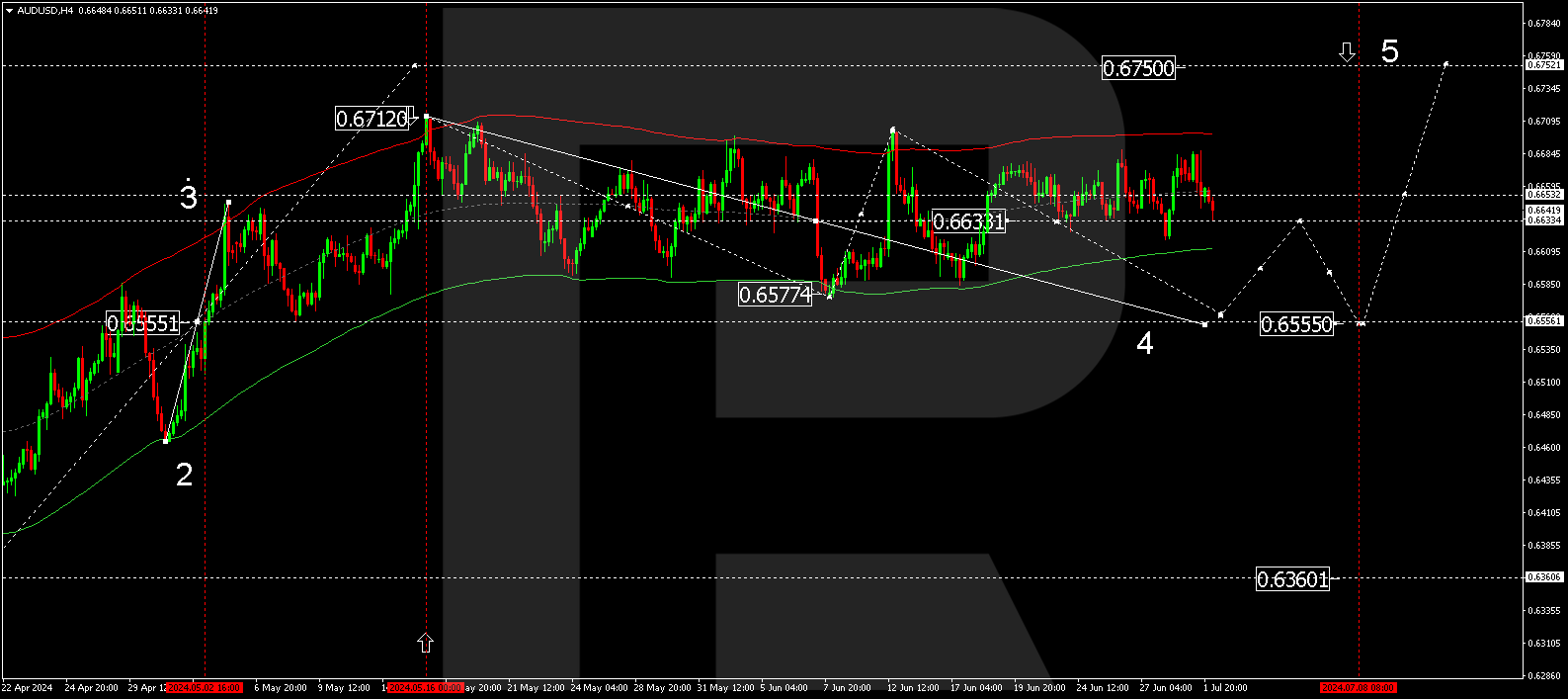

AUDUSD technical analysis

A consolidation range has formed above the 0.6630 level on the AUDUSD Н4 chart and extended to 0.6677 following an upward breakout. Subsequently, the market returned to the 0.6630 level, which is crucial for the AUDUSD forecast for 25 June 2024. With an upward breakout, the price might rise to 0.6750. A downward breakout will open the potential for a decline in the AUDUSD quotes to 0.6565. If this level breaks, the trend might continue towards 0.6424, representing an estimated target.

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 0.6555. The market has reached a local target of the growth wave at the Envelope’s upper boundary – 0.6710. Following this, the price declined to its lower boundary at 0.6577 as part of a correction. Today, the market continues to develop a consolidation range around the Envelope’s central line at 0.6630. With a downward breakout, a decline wave could follow, targeting the Envelope’s lower boundary at 0.6565. An upward breakout might enable a growth wave, aiming for its upper boundary at 0.6750.

Read more - AUDUSD

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks