AUD/USD: low interest rates are desirable

07/05/2018

Current dynamics

Last week, the central bank of Australia, as expected, left the key interest rate unchanged at 1.5%. According to the RBA Governor Philip Lowey, at present there are no arguments in favor of changing the RBA monetary policy.

On Tuesday, Philip Lowy said that "the low level of interest rates continues to support the Australian economy".

At the level of 1.5%, the RBA rate is already since the middle of 2016, and economists believe that the first increase will take place only in 2019. However, interest rates may remain unchanged for an even longer time, given the weak wage growth and the slowdown in the Australian economy.

The RBA raised the forecast for core inflation by mid-2018 from 1.75% to 2.0%, to the lower limit of the RBA's target range of 2% -3%. At the same time, the RBA does not expect further growth in core inflation until June 2020.

On Friday, in the quarterly Monetary Policy Statement, the Reserve Bank of Australia revised upward its forecast for the unemployment rate. Now, given the negative dynamics of the Australian labor market from the beginning of 2018, the long-awaited increase in the RBA rate in the first half of 2019 may be in jeopardy.

Nevertheless, the situation in the Australian labor market remains a key factor in the prospects for raising the key interest rate of the country's central bank.

"The board does not see any weighty arguments in favor of adjusting the key interest rate in the short term", the statement adds.

Economists also warn that due to the weakness of the housing market and the continuing weakening of housing prices in major cities, the RBA will not change rates until 2020.

If pressure on housing prices increases, it will undermine consumer confidence and lead to a slowdown in economic growth. And this, in turn, suggests a possibility of a decrease, rather than an increase in interest rates.

On Tuesday, investors will be attracted by the publication (09:30 GMT) of the Australian government's annual budget plan. The impact of this document on the market and on the quotations of the Australian dollar is high, because it can have a significant impact on the economy.

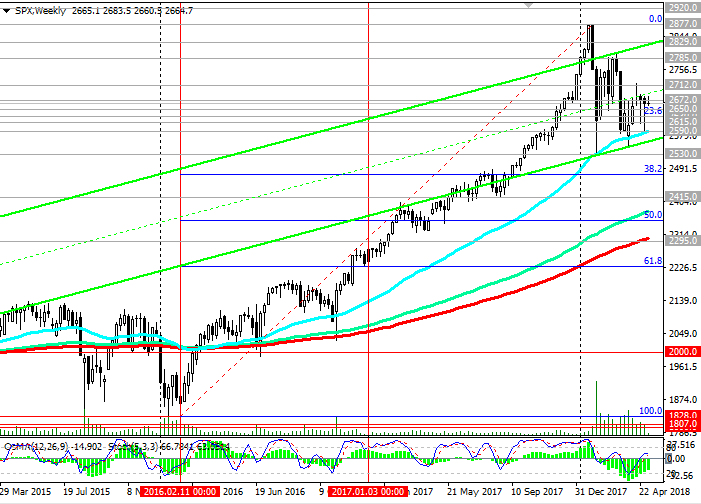

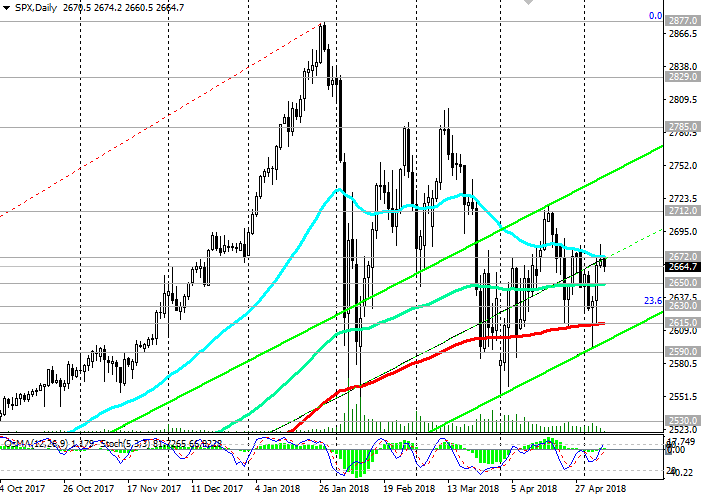

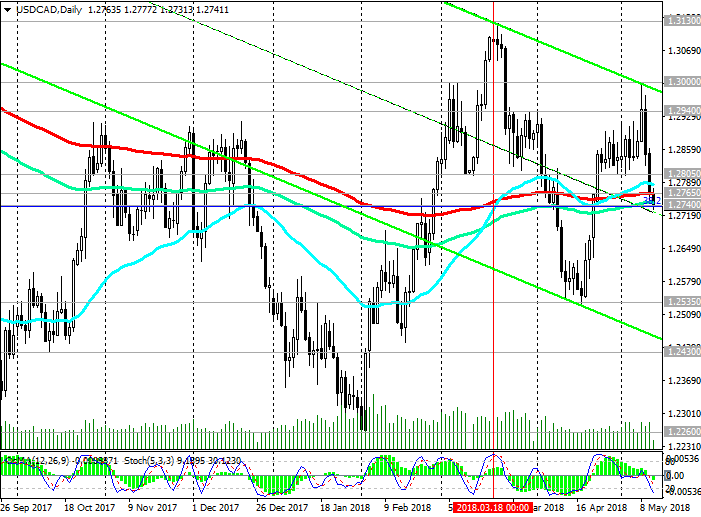

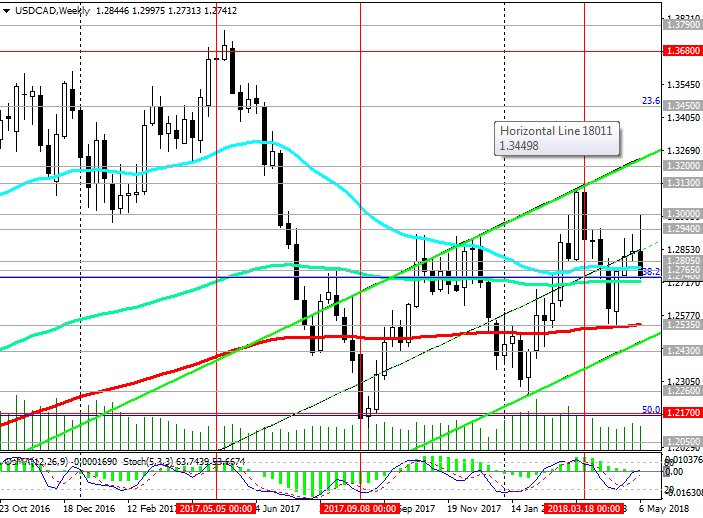

At the same time, the tightening of the monetary policy of the Fed in combination with strong economic data of the US supports the US dollar. Its growth, most likely, will continue in the short term.

The different focus of monetary policy of central banks in the US and Australia will be the main most important long-term factor in favor of weakening the AUD/USD.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

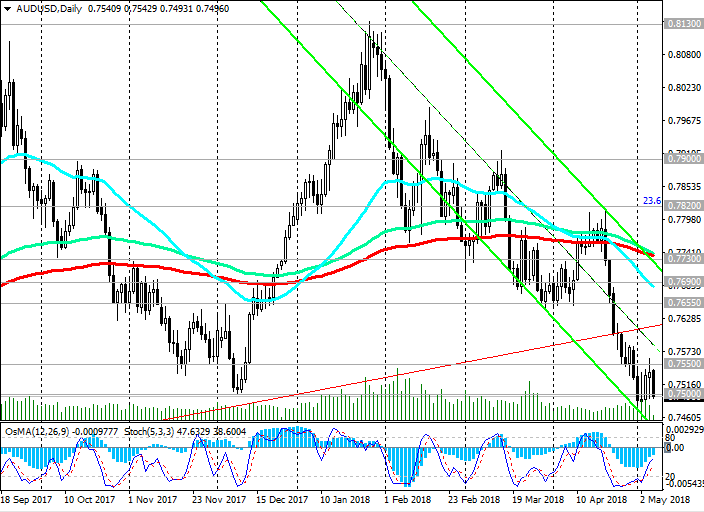

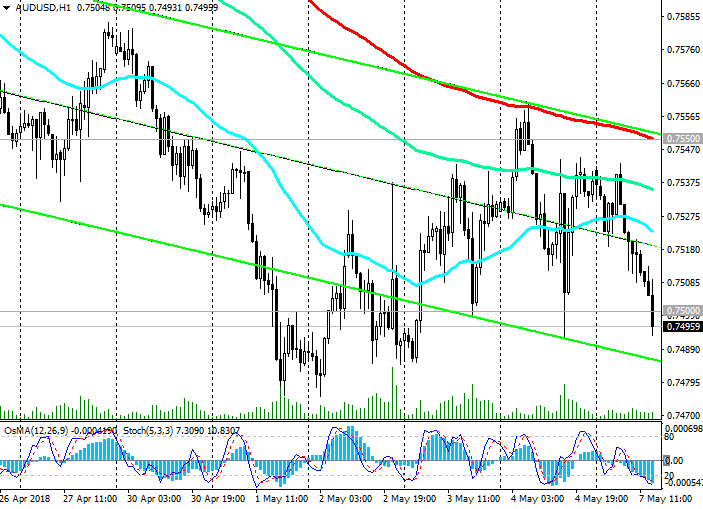

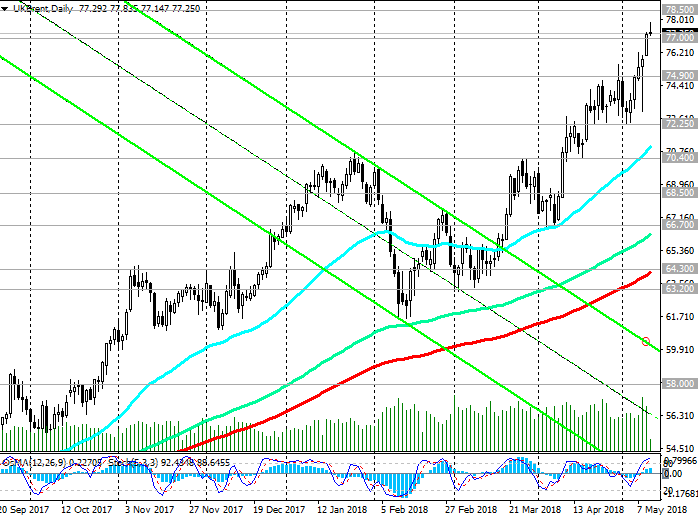

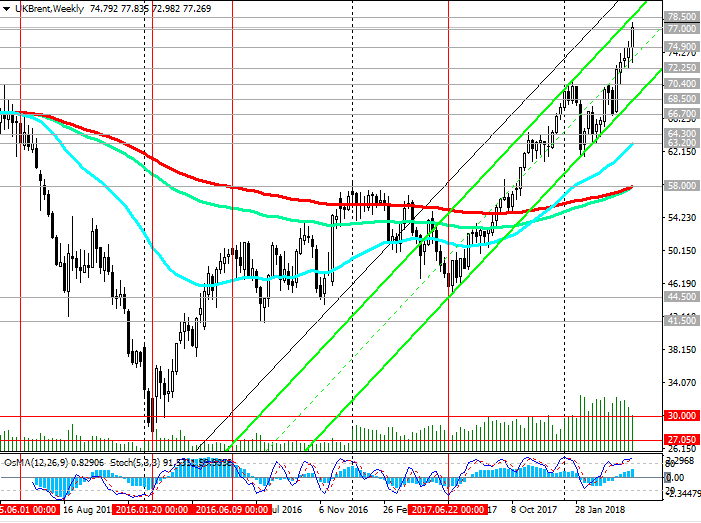

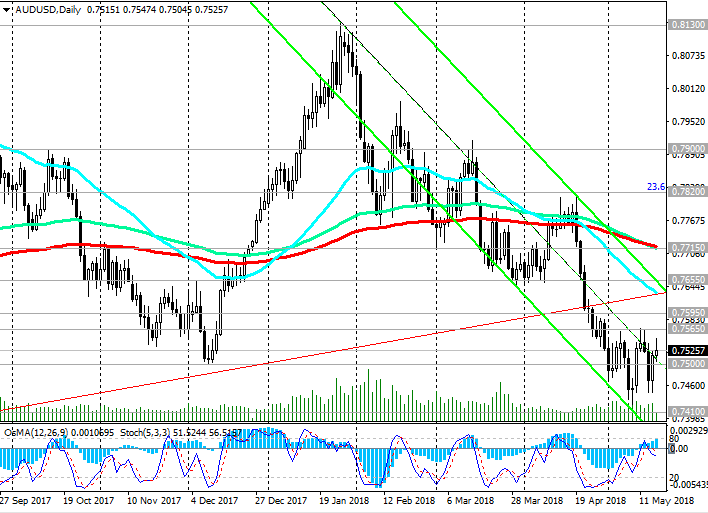

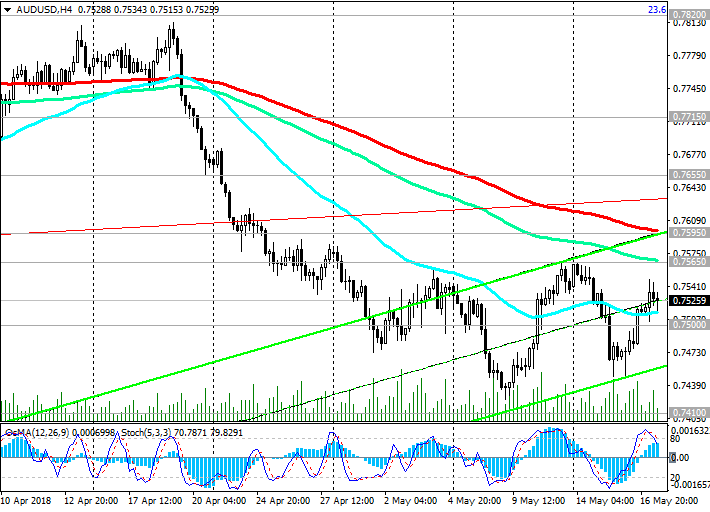

Support levels: 0.7500, 0.7430, 0.7330, 0.7155

Resistance levels: 0.7550, 0.7655, 0.7690, 0.7730, 0.7820, 0.7900, 0.8000

Trading Scenarios

Sell on the market. Stop-Loss 0.7565. Take-Profit 0.7430, 0.7330, 0.7155

Buy Stop 0.7565. Stop-Loss 0.7490. Take-Profit 0.7600, 0.7655, 0.7690, 0.7730, 0.7820, 0.7900, 0.8000

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks