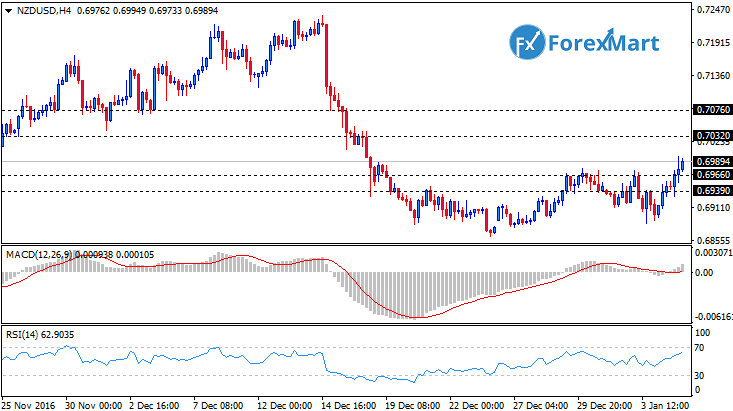

The New Zealand currency had recovered compared to its American counterpart after the data release from China's manufacturing Purchasing Managers Index. Meanwhile, the pair established its recovery during the early trades yesterday in spite of the dollar’s strengthening across the board.

The NZD plunged through an upward trend and beat the 0.6950 level in the middle session of Asian trading. Nevertheless, the upswing that last overnight tried to hold back below the 0.6950 hurdle where the NZD/USD found a renewed selling interest. Moreover, the pair rebounded from the level amid the post-EU open and continued towards the 0.6900 support.

The 4-hour chart showed the price pushed the 50-EMA upwards in the morning trades. The pair was unable to expand its growth and further entered the 50-day moving averages before the outset of the North American session. The 200-EMA together with the 100-EMA sustained its bearish signal and the 50-EMA established a neutral stance. Resistance took the 0.6950 level, support approached the 0.6900 area. The MACD histogram traded on the downside. While the RSI oscillator lies in the neutral zone after it departed in the overvalued readings.

A bearish sentiment ruled on Tuesday. It is highly anticipated that the currency pair’s next target is 0.6900. In case the NZDUSD surpasses the initial target, the price is possible to move ahead to the 0.6850 region.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks