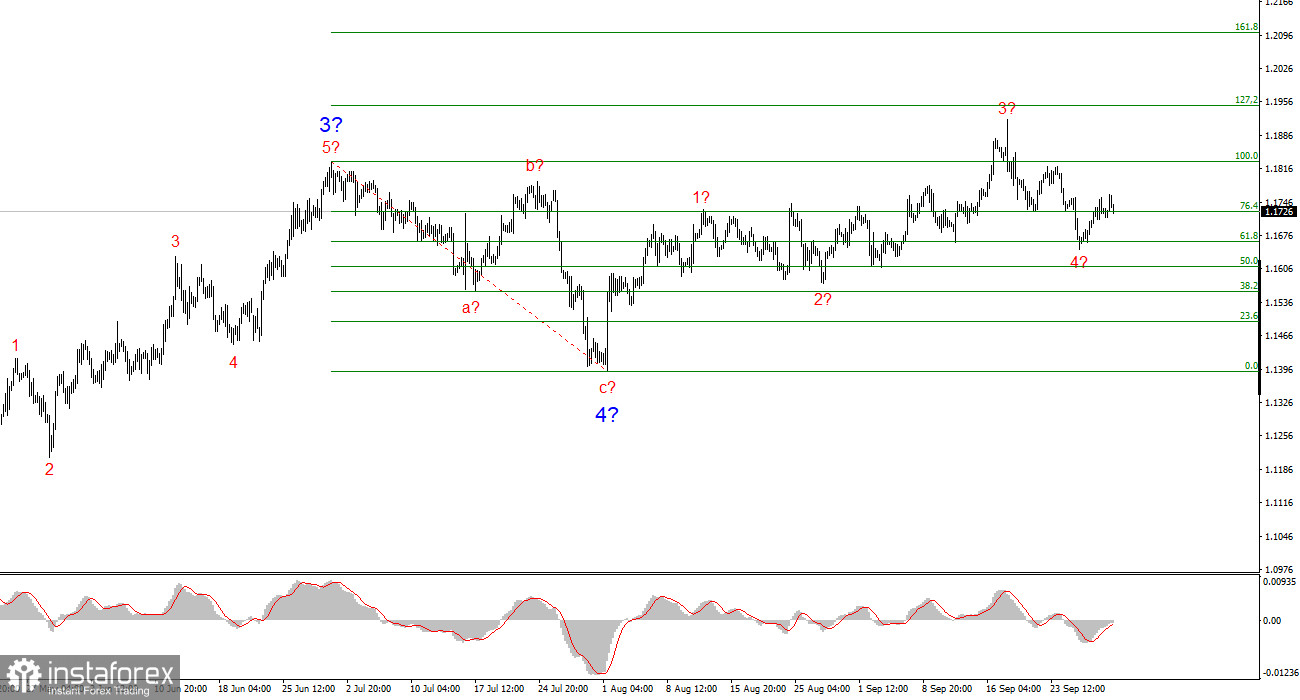

Forex Analysis & Reviews: EUR/USD Forecast for September 19, 2025

The euro has been gradually retreating from its September 17 high. Typically, after the central bank meetings are over and no new trends have been set, investors shift their focus to the balance of economic indicators, which guide monetary policy. Sometimes it seems that retail sales or building permits can't move the exchange rate by 1%, but these releases provide longer-term momentum that can underpin trends for months ahead. The absence of an immediate market response to the Fed's rate change could turn into a medium-term decline for the euro. A cycle of important economic news kicks off next week.

For a medium-term decline in EUR/USD to begin, the price needs to secure a close below the daily MACD line at 1.1720. Then, it needs to break through support at 1.1632, which would confirm the signal and open a path toward 1.1495. If the price finds the resolve to resume growing, the signal will be a breakout above the upper boundary of the new price channel at 1.1919. For now, however, the price is consolidating, gearing up to implement the main bearish scenario.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4gurAS1

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks