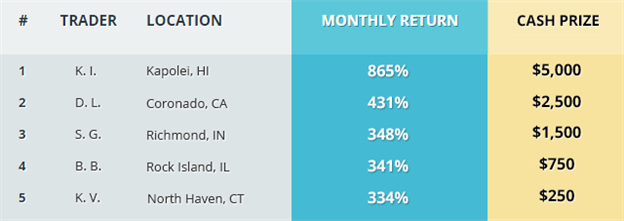

FXCM and DailyFX are happy to announce the winners of Julys $10,000 Monthly Challenge! July’s $10,000 contest wrapped up with K.I. from Kapolei Hawaii taking first prize with an astounding 865% return. Second place was awarded to D.L, from California, produced a monthly return of 431% Rounding out our monthly winners, third place was S.G, (348%). B.B. in fourth. (341%) and finally K.V. came in 5th with a 334% return. Congratulations to all of last month’s challenge winners!

July’s trading contest was an exciting event, with our ultimate winner beating out tens of thousands of competitors with a decisive finish. As well, we had a close race for third place, with just 14% points separating our 3rd and 5th place finishers. So what exactly happened in the month of July? To help get a better insight into last month’s contest, I was able to interview our 2nd place winner D.L.

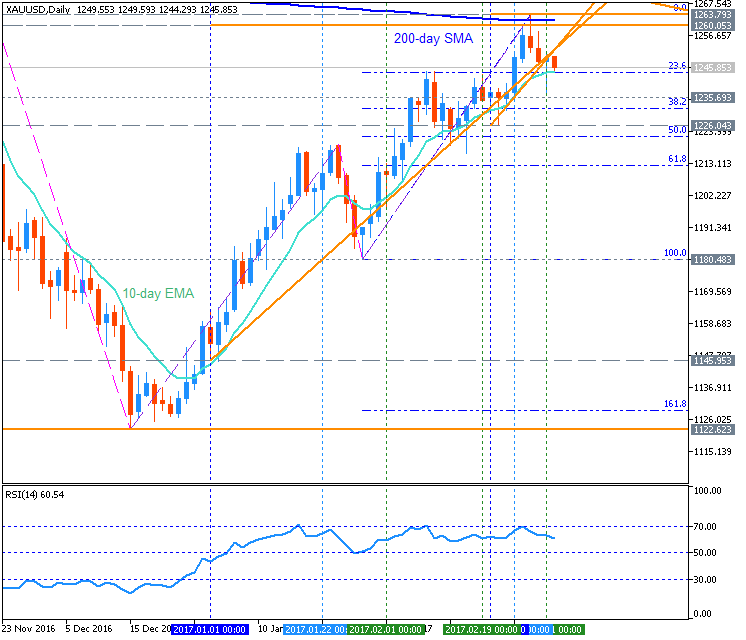

First off, D.L. is a part time trader who enjoys his full time job as a retail sales trader. He has been trading now for 10 years, and now strictly focuses on the Forex market. He enjoys trading Forex because it allows him to taking advantage of the 24 Hour market conditions. D.L mentioned that he likes to places his traders early in the morning and then monitor his trades throughout the day using the FXCM mobile app!

more...

12Likes

12Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks