Talking Points:

- Volatility is the measurement of price variations over a specified period of time.

- Traders can approach low-volatility markets with two different approaches.

- We discuss the Average True Range indicator as a measurement of volatility.

Technical Analysis can bring a significant amount of value to a trader.

While no indicator or set of indicators will perfectly predict the future, traders can use historical price movements to get an idea for what may happen in the future.

A key component of this type of probabilistic approach is the ability to see the ‘big picture,’ or the general condition of the market being traded. We discussed market conditions in the article The Guiding Hand of Price Action; and in the piece we enclosed a few tips for traders to qualify the observed condition in an effort to more properly select the strategy and approach for trading that specific condition.

Volatility is the measurement of price variations: Large price movements/changes are indicative of high volatility while smaller price movements are low volatility.

As traders, price movements are what allow for profit. Larger price variations mean more potential for profit as there is simply more opportunity available with these bigger movements. But is this necessarily a good thing?

The Dangers of Volatility

The allure of high-volatility conditions can be obvious: Just as we said above, higher levels of volatility mean larger price movements; and larger price movements mean more opportunity.

But traders need to see the other side of this coin: Higher levels of volatility also mean that price movements are even less predictable. Reversals can be more aggressive, and if a trader finds themselves on the wrong side of the move, the potential loss can be even higher in a high-volatility environment as the increased activity can entail larger price movements against the trader as well as in their favor.

For many traders, especially new ones, higher levels of volatility can present significantly more risk than benefit.

The reason for this is The Number One Mistake that Forex Traders Make; and the fact that higher levels of volatility expose these traders to these risks even more than low-volatility.

So before we go into measuring or trading volatility, please know that risk management is a necessity when trading in these higher-volatility environments. Failure to observe the risks of such environments can be a quick way to face a dreaded margin call.

Average True Range

The Average True Range indicator stands above most others when it comes to the measurement of volatility. ATR was created by J. Welles Wilder (the same gentlemen that created RSI, Parabolic SAR, and the ADX indicator), and is designed to measure the True Range over a specified period of time.

True Range is specified as the greater of:

- High of the current period less the low of the current period

- The high of the current period less the previous period’s closing value

- The low of the current period less the previous period’s closing value

Because we’re just trying to measure volatility, absolute values are used in the above computations to determine the ‘true range.’ So the largest of the above three numbers is the ‘true range,’ regardless of whether the value was negative or not.

Once these values are computed, they can be averaged over a period of time to smooth out the near-term fluctuations (14 periods is common). The result is Average True Range.

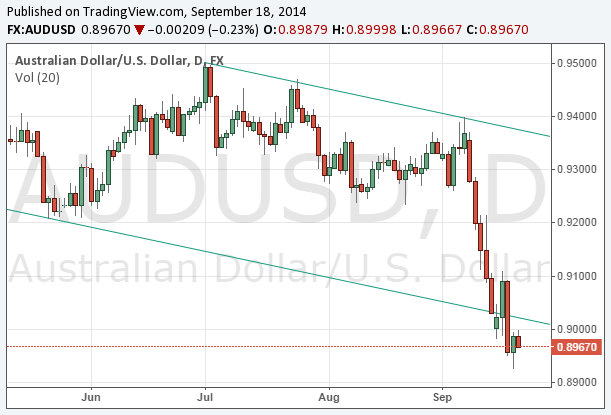

In the chart below, we’ve added ATR to illustrate how the indicator will register larger values as the range of price movements increases:

How to Use ATR

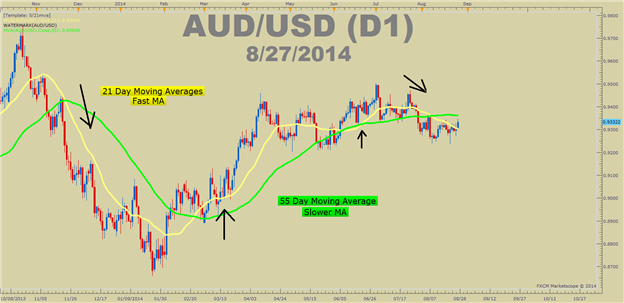

After traders have learned to measure volatility, they can then look to integrate the ATR indicator into their approaches in one of two ways.

- As a volatility filter to determine which strategy or approach to employ

- To measure risk (stop distance) when initiating trading positions

Using ATR as a Volatility Filter

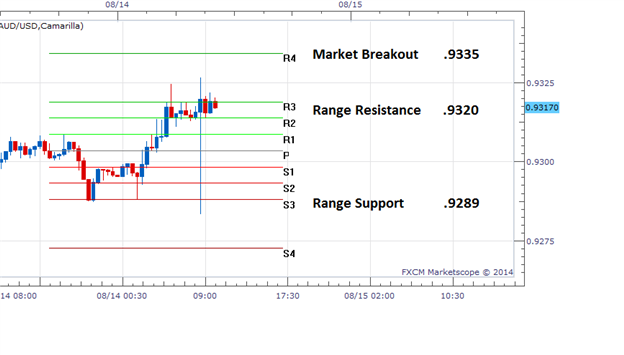

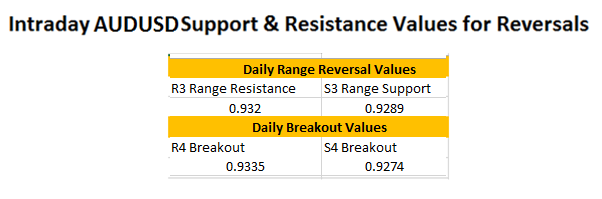

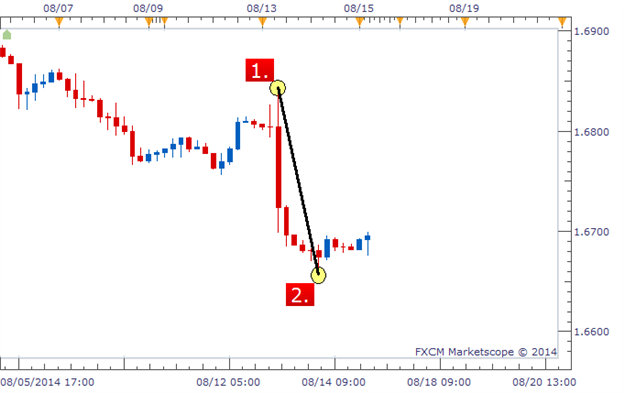

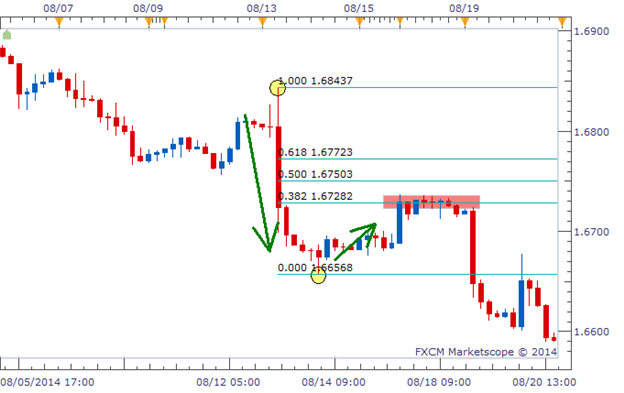

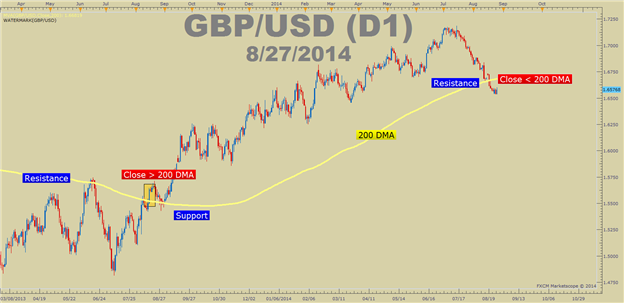

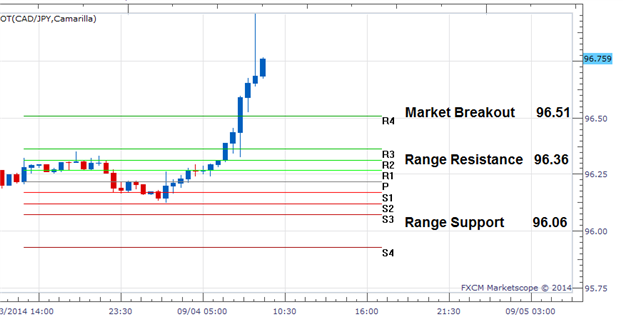

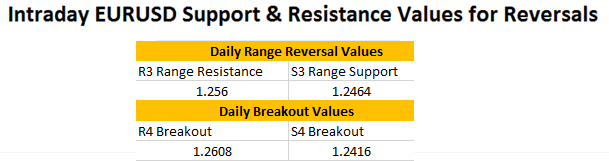

Just as we had seen in our range-trading article, traders can approach low-volatility environments with two different approaches.

Simply, traders can look for the low-volatility environment to continue, or they can look for it to change. Meaning, traders can approach low-volatility by trading the range (continuation of low-volatility), or they can look to trade the breakout (increase in volatility).

The difference between the two conditions is huge; as range-traders are looking to sell resistance and buy support while breakout traders are looking to do the exact opposite.

Further, range-traders have the luxury of well-defined support and resistance for stop placement; while breakout traders do not. And while breakouts can potentially lead to huge moves, the probability of success is significantly lower. This means that false breakouts can be abundant, and trading the breakout often requires more aggressive risk-reward ratios (to offset the lower probability of success).

Using ATR for Risk Management

One of the primary struggles for new traders is learning where to place the protective stop when initiating new positions. ATR can help with this goal.

Because ATR is based on price movements in the market, the indicator will grow along with volatility. This enables the trader to use wider stops in more volatile markets, or tighter stops in lower-volatility environments.

--- Written by James Stanley

More...

12Likes

12Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks