Talking Points:

- The Relative Strength Index can be an extremely versatile indicator

- Like any other indicator, it will never be perfectly predictive

- Three ways of trading with RSI, using various approaches

Indicators can be dangerous.

The reason for this is simple: Indicators have no better chance of predicting the future with 100% accuracy than any of us as human beings do.

With technical analysis, that’s all we’re really doing: Looking at the past to get an idea as to how to best trade future price movements. Technical Analysis can help traders associate the probabilities of success; and indicators can help traders more easily identify high-probability setups.

One of the more universally accepted indicators is RSI, or the Relative Strength Index. This is often one of the first indicators that a trader learns; and after seeing that it doesn’t always work, RSI often becomes one of the first indicators that traders learn to ignore or forget about.

But RSI can offer traders quite a bit more than just what it can do by default. In this article, we’re going to look at three methods for trading RSI.

The Default Use of RSI

The Default manner to trade RSI is to wait for the indicator value to move into ‘Overbought (above 70)’ or ‘Oversold (below 30)’ territory as shown below.

Relative Strength Identification

Once RSI begins moving out of that area, traders can look to trigger a trade in the opposite direction (selling when price leaves overbought territory and buying when RSI leaves oversold territory).

This, in and of itself can be effective; particularly when looked at on longer-term charts and coupled with effective money management.

Method #1: Daily Chart with 1-to-2 Risk-to-Reward Ratio

The simplest way to trade with RSI can also be one of the more effective.

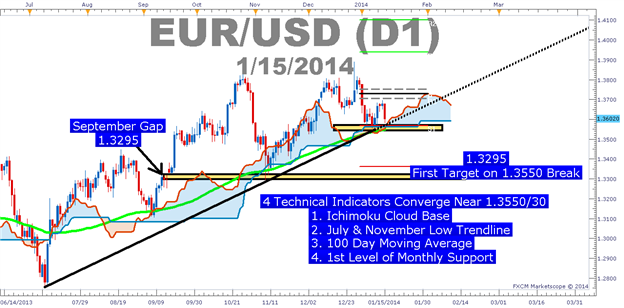

As an example, EURUSD had five RSI crosses on the daily chart in 2013, all of which were sell entries as RSI moved down and through 70. Each of these are identified and numbered on the chart below:

RSI Crossovers can precede enormous movements

Notice that out of the 5 instances of RSI crossover on the above chart, three took place immediately before 500+ pip reversals.

More interesting: the pair trended higher on the year; opening the year at 1.3183, and closing at 1.3776. And yet, we only saw 5 signals, all of which were counter-trend; and 3 of which could have worked out beautifully.

So, even though EURUSD worked higher during the year, three of the five sell signals per RSI could have equated to profitable trades.

Traders can take this a step further by adjusting their risk-reward ratio; because, after all, RSI crossovers are counter-trend entries looking for near-term retracements. If those retracements catch to turn into a full on reversal (such as signal #1 in the above chart), the potential return could be large and outsized.

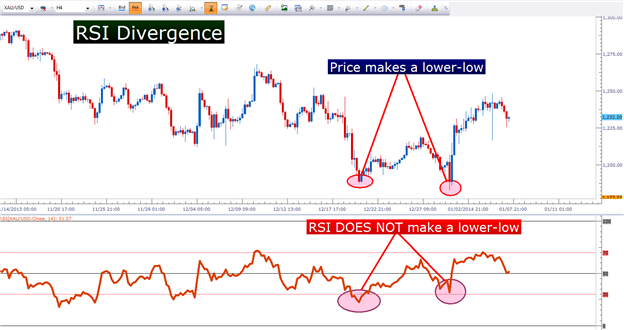

Method #2: Catching Reversals with RSI Divergence

RSI Divergence can be an extremely interesting way to trade with Relative Strength.

RSI Divergence

Key importance with RSI divergence is risk management; because if the trend does not reverse, the trade can be extremely costly as the trader sits in a counter-trend position.

RSI divergence may be rarer than standard RSI entries, but traders still need to look at these potential setups with context: Using risk-reward ratios of 1-to-2 or greater when looking for reversals.

Method #3: As a Trigger with a Longer-Term Trend Filter

Multiple Time Frame Analysis can bring considerable value to the technical trader; key of which is allowing the trader to assimilate price action from varying points of view.

Traders can look to the longer-term chart to get an idea for the general trend direction; and then look to enter on the shorter-term chart in consideration of the longer-term trend. The longer-term chart brings the luxury of allowing the trader to see the ‘bigger picture,’ while the shorter time frame allows the trader to get more granular with their entry and stop placement.

A primary example of this form of analysis would be the combination of the Daily and the 4-hour chart. Traders can observe the trend on the daily chart, and then after grading the trend can look to place entries on the 4-hour chart.

Multiple Time Frame Analysis can help traders use RSI more effectively

-- Written by James Stanley

More...

12Likes

12Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks