Don’t Fight the Fed - Bernanke’s Words Will Drive US Dollar Lower

Fundamental Forecast for US Dollar: Bearish

- US Dollar has held on, but next Dollar move likely lower

- Prepared statements by Fed Chairman Bernanke sink the USD

- Technical forecasts suggest USDOLLAR could fall further

The US Dollar fell against major currencies except the Japanese Yen as the S&P 500 surged to fresh record-highs, and dovish commentary from Fed Chairman Ben Bernanke suggests the Dow Jones FXCM Dollar Index (ticker: USDOLLAR) could fall to fresh lows.

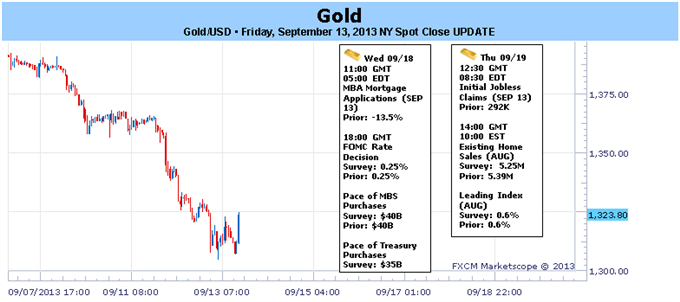

Bernanke put a significant damper on expectations that the Federal Open Market Committee (FOMC) would “taper” its Quantitative Easing measures through its upcoming meetings, and the result was enough to force the Dollar lower across the board. Stock markets likewise breathed a sigh of relief and traders were happy to send the S&P 500 to fresh record peaks. A broader lull in volatility suggests we could see further Dollar weakness and S&P gains through the weeks ahead.

Why might volatility remain low and—just as importantly—what could disturb the market lull?

It all starts and ends with the US Federal Reserve. Bernanke’s infamous “taper” bombshell sparked a financial market panic and sent the Dow Jones FXCM Dollar Index to its highest levels in three years. It seems fitting to note that the dovish shift in Fed commentary has caused similar market ease, and the USDOLLAR fell sharply when Bernanke backtracked on the taper talk. Put simply, the Dollar’s next moves will almost certainly depend on similar shifts from the Fed. As things stand, the Greenback could fall further off of recent peaks.

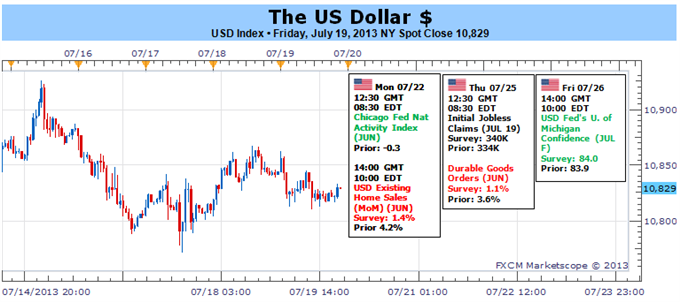

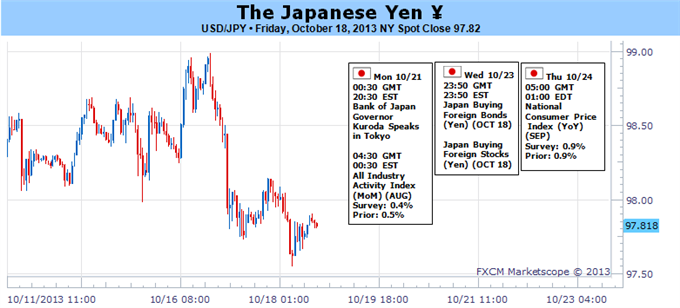

The coming week’s calendar won’t provide much in the way of potentially market-moving event risk, and indeed that supports the case for low volatility and USD weakness. Possible exceptions include the weekend’s Japanese upper house elections and a late-week US Durable Goods Orders report.

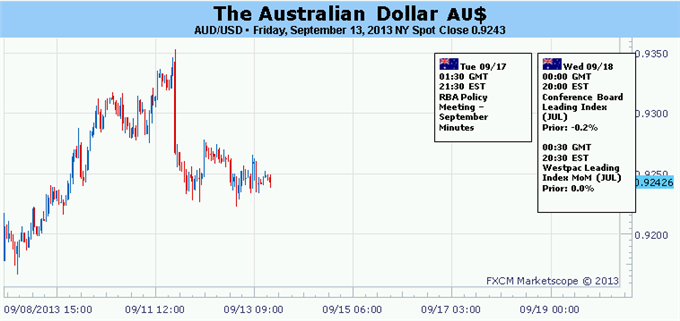

Japan’s elections are likely to cement Prime Minister Abe’s hold of power and reaffirm commitment to so-called “Abenomics”—extremely loose monetary policy and expansionary fiscal policy that has sunk the Japanese Yen. Though unlikely, any surprises could force a substantial Japanese Yen bounce (USDJPY weakness), but financial market volatility could mean Dollar strength elsewhere.

Traders otherwise look to the week’s US Durable Goods orders report to gauge the health of domestic investment activity and future economic growth. We wouldn’t normally watch for big moves on surprises, but the market has become so data-dependent that any particularly big misses could force sharp Dollar moves. Consensus forecasts call for a respectable gain in both the headline figure and the less volatile “Ex-Transportation” result. If we see a sharply better-than-expected gain, the Greenback would likely rally.

There’s a popular saying among traders that seems to hold true in current conditions: “Don’t fight the Fed.” Initially it seemed as though the Fed was likely to begin withdrawing Quantitative Easing measures almost immediately, and all QE-linked trades pulled back sharply. Since then, however, Bernanke and co. have made clear that the next move will have to come on strong economic data.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks