Forex Weekly Outlook July 7-11

The dollar managed to beat the euro and the yen, but stayed behind the mighty pound and the recovering loonie. Will these trends continue? The FOMC Meeting Minutes, Australian, Canadian employment figures and the rate decision in the UK are the main market movers on FX calendar. Here is an outlook on the top events this week.

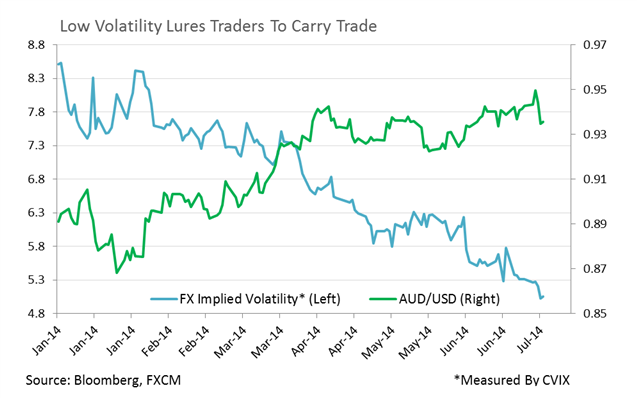

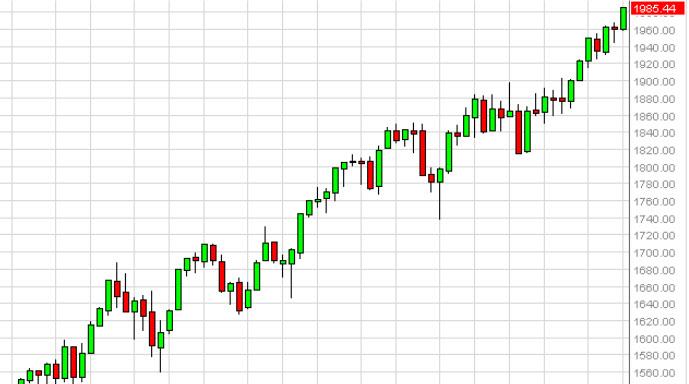

The US labor market is certainly picking up, with a gain of 288K jobs and another drop of the unemployment rate to 6.1%. This has been the fifth straight month where job gains surpassed 200,000 positions. Job growth averaged 231,000 per month in the first half of the year. Is this enough to move the Fed? In the euro-zone, Draghi maintained a dovish message, leaving the door wide open to QE. The pound enjoyed positive PMIs and continued advancing against both currencies. The Australian dollar suffered a blow from the RBA after reaching highs while another commodity currency, the C$,enjoyed its momentum. Let’s start,

- JOLTS Job Openings: Tuesday, 14:00. This lagging measure of US employment is closely watched by the Fed, which looks at a wider array of job figures and not only the unemployment rate. Job openings jumped to 4.45 million in April and are now expected to advance to 4.53 million.

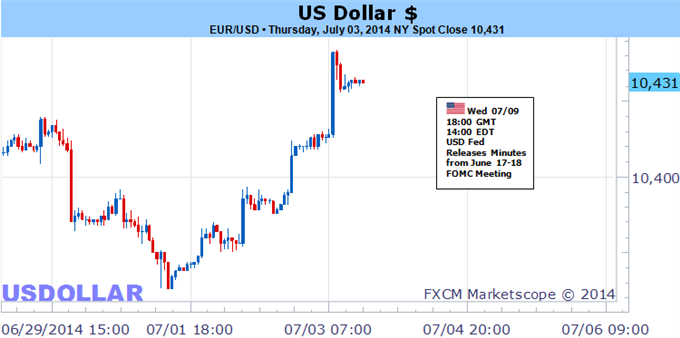

- FOMC Meeting Minutes: Wednesday, 18:00. In the June meeting, the Fed tapered for the fifth time as expected, and also lowered growth forecasts. In the accompanying press conference, Yellen maintained a dovish tone, weighing on the dollar. Given similar moves in the past, can the meeting minutes reveal a slightly more hawkish Fed than the initial message suggested?

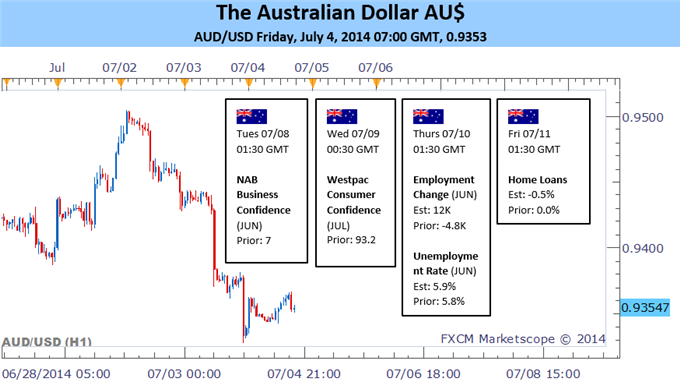

- Australian employment data: Thursday, 1:30. Australia’s unemployment rate remained unchanged at 5.8% in May, despite an unexpected drop of 5.9% in the number of jobs. Analysts expected a rise of 10,000 positions as well as a climb to 5.9% in Jobless claims. However, not all was bad, the number of full time positions increased by 22,200 while part time positions declines by 27,000. The unemployment rate increased to a decade-high 6.0% in January, while analysts and the Treasury expecting it to edge higher this year during the transition away from mining-led growth. Australia’s job market is expected to increase by 12,300 while the unemployment rate is expected to stand at 5.9%.

- UK rate decision: Thursday, 11:00. There was a general belief that the BOE’s would not increase interest rates until after the General Election in May 2015. However recent market data suggests the central bank may raise rates to 3% much sooner. Mark Carney originally bonded between the UK unemployment rate and BOE base rate, saying he will raise rates of unemployment drops below 7%. This goal has been unexpectedly reached forcing Carney to change the rate hike trigger to18 economic indicators. Most analysts expect a gradual rise in rates which will continue until 2017 with a first rise to 0.75% within the fourth quarter of this year.No chnge in rates is expcted this time.

- US Unemployment Claims: Thursday, 12:30. Initial applications for jobless benefits inched higher by 2,000 last week to a seasonally adjusted 315,000, staying near pre-recession levels. The reading was broadly in line with market forecast. the four-week moving average of continuing claims dropped to 2,580,250, declining by 6,000 from the prior week’s revised level of 2,586,250. US jobless claims are expected to reach 316,000 this time.

- Canadian employment data: Friday, 12:30. Canada’s unemployment rate unexpectedly climbed to 7% in May from 6.9% in the previous month amid job addition of 25,800. The main gain was part time positions, while full employment dropped 29,100. The readings were broadly in line with market forecast. The bank of Canada stated that rising global demand and a lower Canadian dollar will boost Canadian economic growth. Canadian labor market is expected to add 26,200 jobs, while the unemployment rate is predicted to remain unchanged at 7%.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks