Forex Weekly Outlook July 14-18

The yen managed to gain some ground in a week that saw some fear return to the markets. What’s next for currencies? Public appearances from Yellen, Draghi and Carney, rate decisions in Japan and Canada and plenty of important US figures are the highlights of a busy week. Market movers on our calendar for this week. Here is an outlook on the major events to change Forex trading.

Last week FOMC Meeting Minutes release showed that the Fed is finally moving towards preparing the markets for monetary normalization. The Fed is on course to end QE in October 2014, with a larger tapering of $15 billion. However there wasn’t any clear indication regarding the possible timeline for a rate hike. In the euro-zone, we had a flashback from the dark days of the debt crisis, with fresh worries from Portugal. The pound was capped amid some weak UK data. And both in Australia and in Canada, employment data weighed on the local currencies. Let’s start:

- Mario Draghi speaks: Monday, 17:00. ECB President Mario Draghi is expected to testify before the Committee on Economic and Monetary Affairs of the European Parliament, in Strasbourg. He may talk on the ongoing weak inflation, despite the ECB’s recent moves. Volatility is expected, especially if Draghi refers to the exchange rate of the euro and to the probability of QE, a topic which is high on the agenda of policymakers.

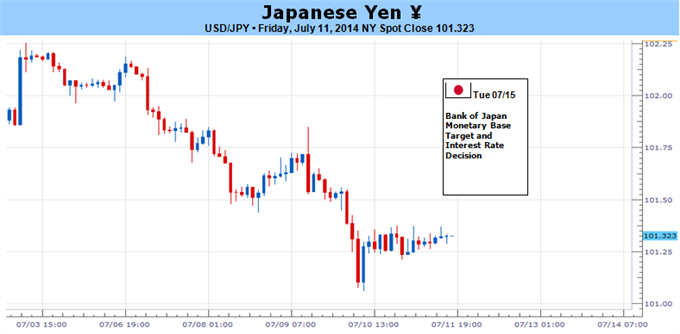

- Japan rate decision: Tuesday. The Bank of Japan decided to keep monetary policy unchanged on its June meeting, pledging to increase monetary base at annual pace of 60-70 trillion yen. The central bank noted the economy is progressing at a moderate pace in line with expectations and revised up its outlook on overseas economies in light of a progress in industrial output.

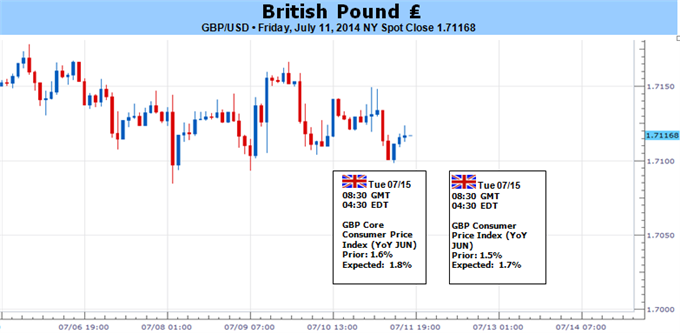

- UK inflation data: Tuesday, 8:30. Inflation in the UK declined in May to a four and a half year low of 1.5%, following 1.8% in posted in April. Lower flight rates and food prices pushed inflation down. Inflation remained below the BOE’s 2% target for the sixth month. However prices still increase faster than average earnings influencing consumer spending. CPI is expected to reach 1.6%.

- Mark Carney speaks: Tuesday, 9:00. BOE Governor Mark Carney will speak about the Financial Stability in London. We have seen his strong influence on markets by talking about a rate hike at first and then saying the comments were his personal views.

- German ZEW Economic Sentiment: Tuesday, 9:00 Investor sentiment continued to decline in June reaching the lowest level in 18 months, down 3.3 points to 29.8. Economists expected the index to reach 35.2. This was the sixth consecutive fall indicating a grim outlook for economic growth unlike the 5.6 points rise to 67.7 for current economic conditions. However the ZEW survey can be volatile. German sentiment is expected to rise to 33.4.

- US retail sales: Tuesday, 12:30. U.S. retail sales gained 0.3% in May, less than the 0.5% rise projected by analysts, following a 0.5% increase in the previous month. However the positive growth trend in the US employment market leaves less room for concern. Meanwhile core sales, excluding autos increased 0.1% in May after a 0.4% increase in the previous month. Retail sales are expected to rise 0.6%.

- Janet Yellen speaks: Tuesday, 14:00. Federal Reserve Chair Janet Yellen will testify before the US Senate in Washington DC. Important issues may be raised such as the final taper decision, inflation situation and rate hike schedule. According to a top Fed watcher in the WSJ, the time may be ripe for Yellen and her colleagues to acknowledge the improvement in the US economy, especially as the Fed’s favorite job figure is clearly on the rise.

- UK employment data: Wednesday: 8:30. The number of people filing claims for unemployment benefits in the U.K dropped more than expected in May, falling by a seasonally adjusted 27,400, while the unemployment rate plunged to 6.6% from 6.8% in April. Analysts expected jobless claims to reach 25,000 and unemployment rate to 6.7%. Meanwhile, the average earnings index edged up by a seasonally adjusted 0.7% in the three months to April, less than the 1.2% increase projected, after rising by 1.9% in the three months to March. The number of Jobless people is expected to decline by 27,100 and the unemployment rate is expected to remain 6.6%

- US PPI : Wednesday, 12:30. Producer prices in the U.S. fell unexpectedly in May by 0.2%, confirming that inflation is mild. Chipper food and gas pushed PPI down after two strong climbs raising hopes for higher inflation figures. In the last 12 months, producer prices increased 2%, in line with the Federal Reserve’s inflation target following 2.1% in April. Core PPI, excluding food and energy products, remained unchanged in May. Producer prices are expected to rise to 0.4%.

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada maintained its overnight rate at 1%. Inflation moved closer to the central bank’s target of 2%. The Canadian economy grew at a modest rate in the first quarter, troubled by by severe weather and supply constraints. However lower Canadian dollar and a rising foreign demand are expected to boost exports. Improved corporate profits, especially in exchange rate-sensitive sectors, should also support higher business investment in the coming quarters. The next change in monetary policy will depend on new information and its influence on the balance of risks. The BOC may be somewhat more dovish after the disappointing employment numbers.

- US Building Permits: Thursday, 12:30. The number of building permits issued in the U.S. declined more-than-expected in May, falling 6.4% to a seasonally adjusted 991,000 units. Analysts expected a rise to 1.07 million units. Meanwhile, housing starts declined 6.5% to a seasonally adjusted 1.001 million units from April’s total of 1.071 million, worse than the 3.7% drop predicted by analysts. The number of building permits is expected to reach 1.04 million this time.

- US Unemployment Claims: Thursday, 12:30. Initial jobless claims fell by 11,000 last week reaching 304,000, well below estimates of a 315,000 rise. The reading brought unemployment claims near to a seven-year low of 298,000. The four-week moving average, fell to 311,500, lower by 3,500 from the unrevised average of 315,000 in the previous week. The number of jobless claims is expected to rise by 310,000.

- US Philly Fed Manufacturing Index: Thursday, 14:00. The manufacturing sector around the Philadelphia region edged up in June, reaching 17.8, above May’s reading of 15.4. Economists expected the survey to reach 14.3. This was the fourth consecutive month in positive territory and the strongest figure since September. New orders expanded by 6 points to 16.8, new shipments increased to 15.5, following 14.2 in May and the employment index also edged up to 11.9, from May’s reading of 7.8. The positive shifts suggest the US manufacturing sector is picking up. The manufacturing sector in the Philadelphia area is expected to decline to 15.6.

- US UoM Consumer Sentiment: Friday, 13:55. U.S. consumer sentiment declined in June to 81.2 down from 81.9 posted in May, but the lower figure does not necessarily suggests a downside trend. Consumers were positive regarding the past six months. Current economic conditions edged up to 95.4 from 94.5 and was below a forecast of 95.7 and consumer expectations declined to 72.2 from 73.7, and missed an expected 74.6. Consumer sentiment is expected to rise to 83.5.

That’s it for the major events this week. Stay tuned for coverage on specific currencies

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks