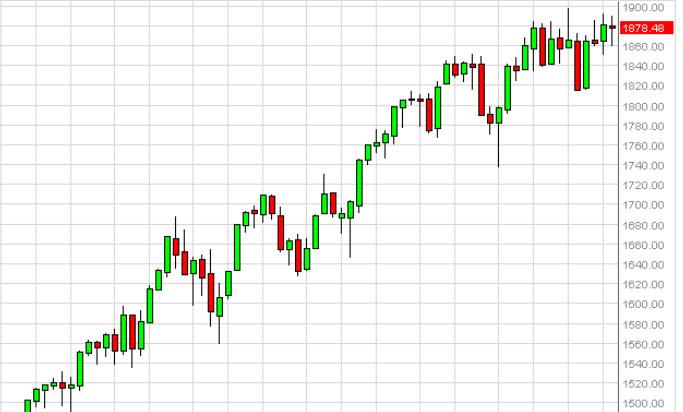

S&P 500 forecast for the week of May 12, 2014, Technical Analysis

The S&P 500 as you can see initially fell during the week, and then bounced off of the 1860 level. That being the case, it appears that the market has formed a hammer for the week, but now it is obvious more than ever that the 1900 level needs to be overcome in order to start going long on a longer-term basis. We believe that will ultimately happen, so therefore on a move above that level we would not hesitate to get involved. Pullbacks all the way to the 1820 level should be supportive as well, as we see plenty of support between here and there.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks