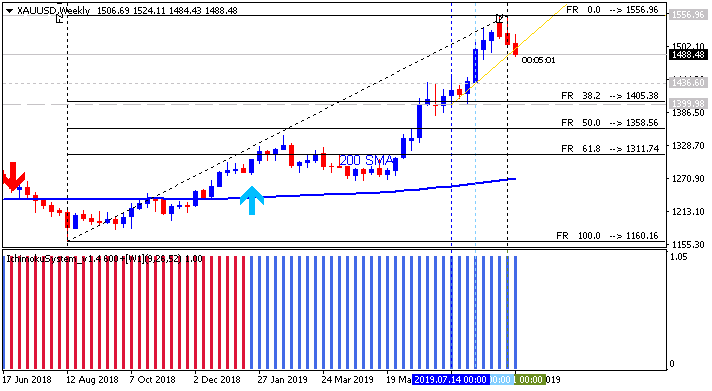

From a technical perspective, gold was likely due for a noticeable pullback judging by the red-hot relative strength index (RSI). The RSI has been increasingly sending an ‘overbought’ signal due to the 13 percent runup in the commodity since bottoming August of last year. As such, the selling in gold could be viewed as a healthy ‘reversion to the mean’ with prices consolidating back towards its moving average.

Although, gold bulls were likely disappointed after the 0.786 Fibonacci retracement line – which rests around the psychological $1,300 support level – did not hold with prices breaking below this consolidation area. This may have soured sentiment further and induced additional selling as short-term momentum traders react to the apparent end of gold’s parabolic ascent.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks