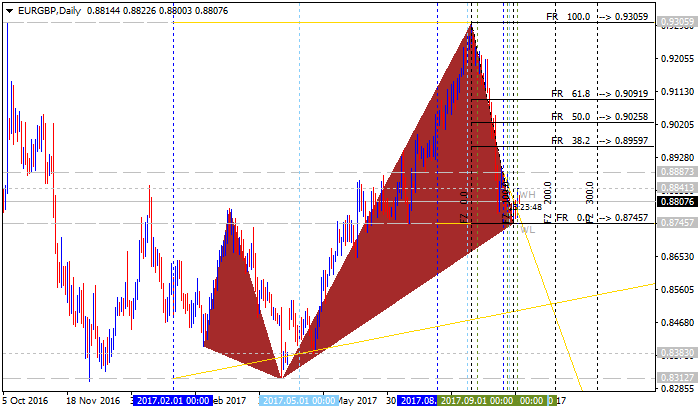

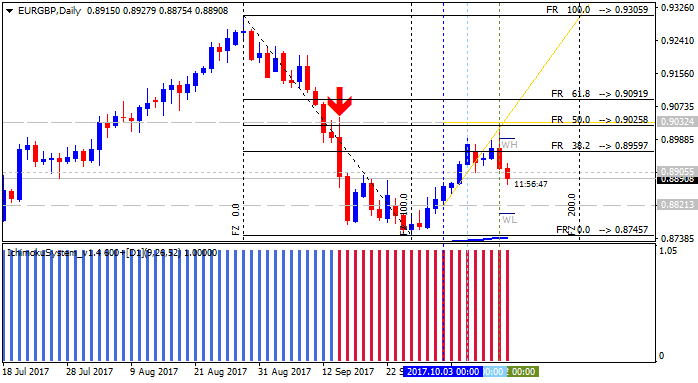

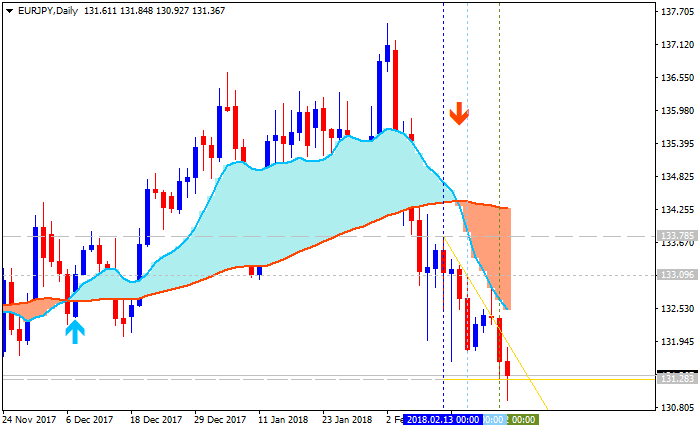

Near-term term resistance is at 0.9150, the 38.2% Fibonacci expansion, a daily close above that opening the door for at challenge of the 50% level at 0.9231. Alternatively, a reversal below rising trend line support at 0.9090 exposes the 23.6% Fib at 0.9051, followed by the 14.6% expansion at 0.8990.

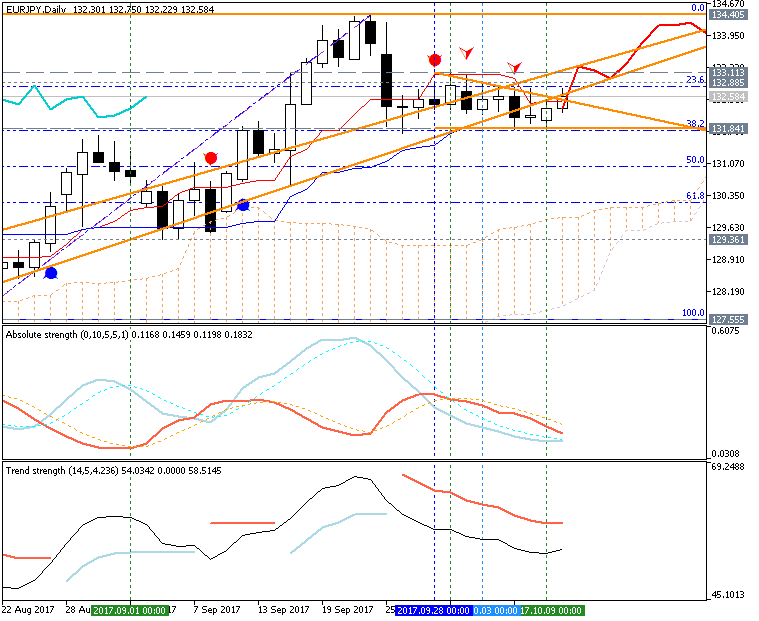

Negative RSI divergence is not sufficient by itself to justify taking a short position without further confirmation. It is enough of a warning not to try for the long side however, at least for now. With that in mind, opting for the sidelines seems most prudent until greater clarity emerges.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks