Forex Weekly Outlook Mar. 24-28

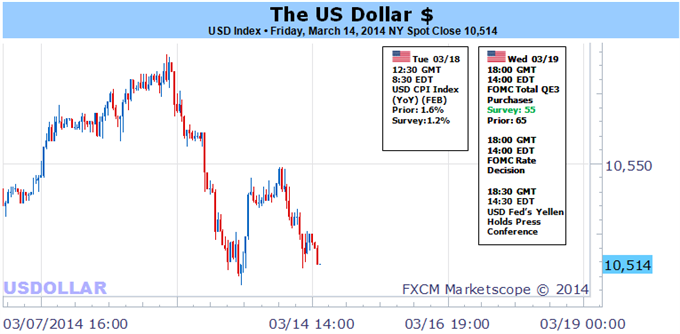

The US dollar had a successful week, rising against most currencies thanks to a hawkish move from the Federal Reserve. German Ifo Business Climate, Inflation data in the UK, US consumer sentiment and housing data as well as jobless claims are the highlight events . Here is an outlook on the main market-movers this week.

- German Ifo Business Climate: Tuesday, 9:00. German business sentiment edged up in February to 111.3 from 110.6 in January. The release was better than the 110.7 predicted by analysts. The rise suggests that economic recovery is continuing to improve despite some weak figures in exports and industrial output. The survey shows retailers are more satisfied with current economic conditions and consumer spending is rising. A small decline to 110.9 is predicted this time.

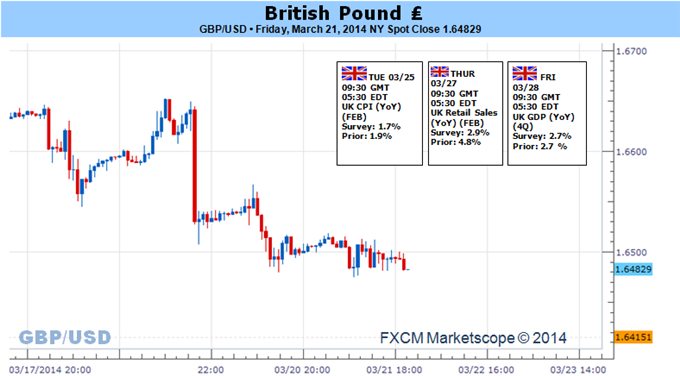

- UK inflation data: Tuesday, 9:30. Inflation in the UK fell in January to 1.9% from 2.0% in the previous month due to lower tobacco prices. The rate declined below the Bank of England's 2% target for the first time in more than four years. In the first half of 2013 inflation nearly reached 3.0% but descended in the second half of the year. Prime minister David Cameron commented that this fall in inflation is further evidence that UK’s economic plan is working. Low inflation enables future planning without surprises. Another decline to 1.7% is anticipated now.

- US CB Consumer Confidence: Tuesday, 14:00. Americans were more pessimistic about the US economy in February according to the Conference Board survey. Consumer confidence declined to 78.1 from 79.4 in January, contrary to predictions for 80.2 points. The Expectations Index, fell to 75.7 points in February from 80.8 January's 80.8. Responders were concerned over the short-term outlook for business conditions, jobs, and earnings. Meanwhile, current conditions assessment has improved. Consumer confidence is expected to improve to 78.7.

- US New Home Sales: Tuesday, 14:00. New U.S. home acquisitions edged up to a 468,000 annualized pace in January, exceeding forecasts of a 406,000 reading. This five year high release was preceded by 427,000 in December, indicating the housing sector remains strong despite recent falls, even in the midst of unusually cold weather. If the job market continues to improve, the housing sector would return to solid growth. Home sales are expected to reach 447K this time.

- US Durable Goods Orders: Wednesday, 12:30. Orders for long-lasting U.S. goods excluding transportation unexpectedly climbed 1.1% in January following a 1.9% plunge in December, suggesting factory activity may yet improve despite recent falls. However, durable goods fell 1.0% in January after posting a 4.3% fall in the previous month. Nevertheless, the harsh weather conditions had a big role in the recent industrial decline. The manufacturing sector is expected to do better in the coming months. A small rise of 0.3% is anticipated this time.

- US Unemployment Claims: Thursday, 12:30. US jobless claims rose less than expected last week, increasing 5,000 to 320,000 Analysts expected claims to reach 327,000. The four-week moving average declined by 3,500 to 327,000. Continuing claims increased to 2,889,000, compared to a downwardly revised 2,848,000 recorded a week earlier. The better than expected release suggests the weak Non-farm payrolls release was a onetime event affected by the cold weather. Jobless claims are expected to reach 326,000.

- US Pending Home Sales: Thursday, 14:00. Contracts to buy existing U.S. homes edged up 0.1% in January after a 5.8 drop caused by unusual winter storms, harsh weather and limited inventory. This small scale rise was less than the 2.9 climb anticipated by analysts. Nevertheless, conditions are expected to improve in the coming months despite tight credit conditions. A further rose of 0.2% is expected now.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks