Talking Points:

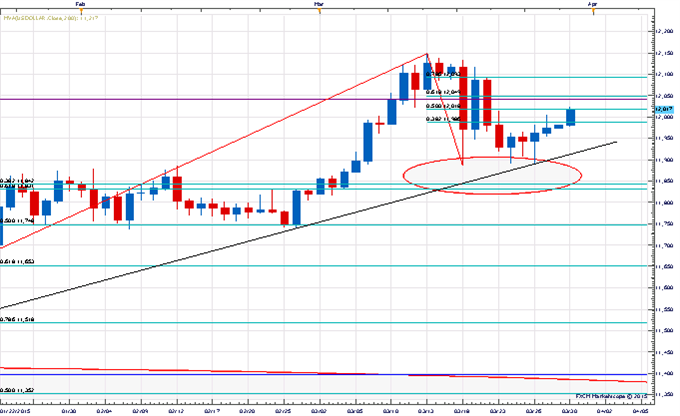

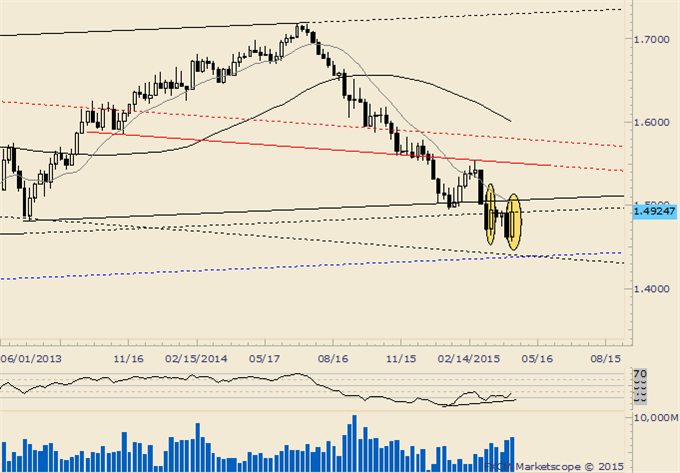

- US Dollar Continues to Tread Water at February Low

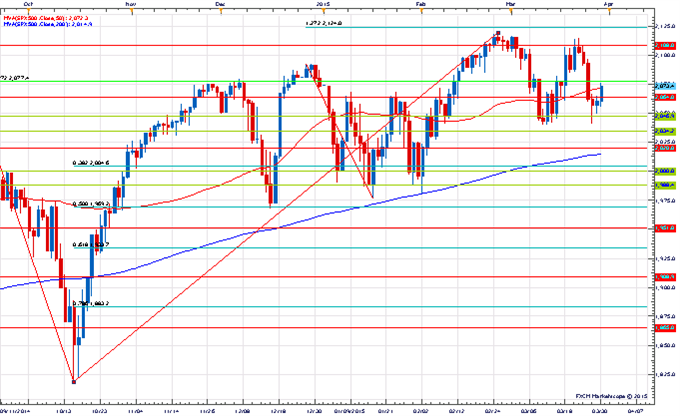

- S&P 500 Stalls After Sliding to Two-Month Support

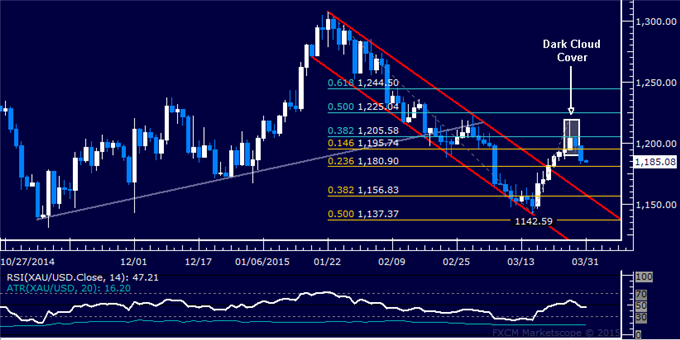

- Gold Prices May Be Readying to Decline Once Again

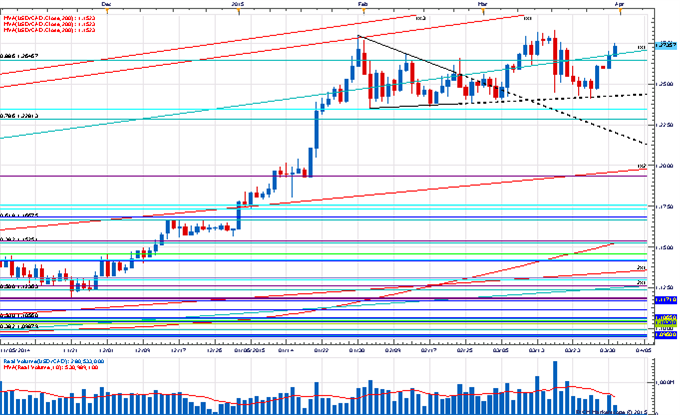

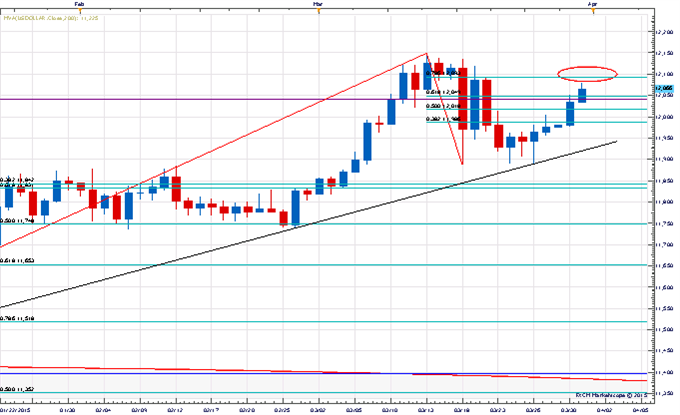

US DOLLAR TECHNICAL ANALYSIS – Prices turned lower as expected, with prices digesting losses near monthly lows. A daily close below the 11858-86 area (23.6% Fibonacci retracement, March 18 low) exposes the 38.2% level at 11679. Alternatively, a reversal back above the 14.6% Fib expansion at 12066 clears the way for a test of the 12149-77 zone (23.6% threshold, March 13 high).

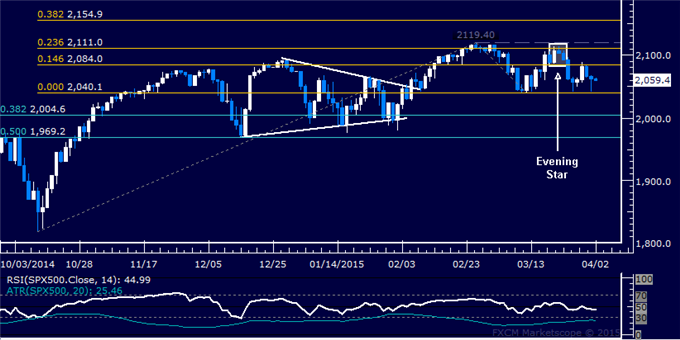

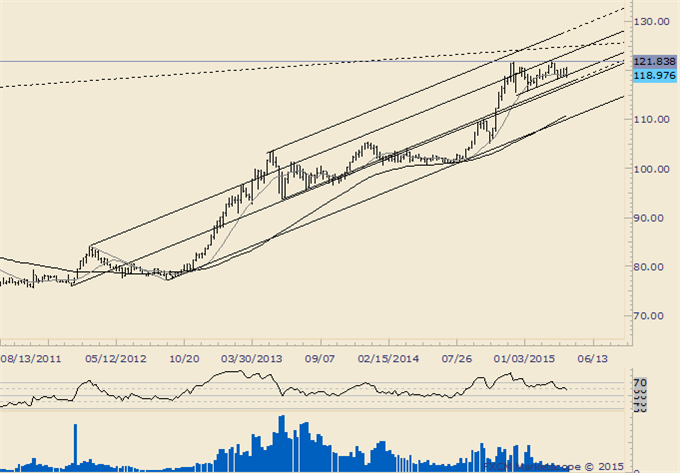

S&P 500 TECHNICAL ANALYSIS – Prices declined as expected after putting in a bearish Evening Star candlestick pattern below February’s swing high. A daily close belowchannel floor support at 2060.50 exposes the March 12 low at 2040.10. Alternatively, a reversal above the 14.6% Fibonacci expansion at 2084.00 targets the 2111.00-19.40 area (23.6% level, February 25 high).

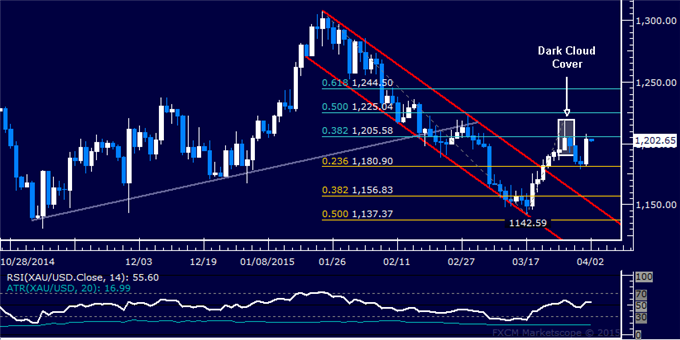

GOLD TECHNICAL ANALYSIS – Prices may be preparing to turn lower after putting in a bearish Dark Cloud Cover candlestick pattern. A daily close below the 23.6% Fibonacci retracement at 1181.51 exposes the 14.6% level at 1166.67. Alternatively, a reversal above the 38.2% Fib at 1205.58 targets the 50% retracement at 1225.04.

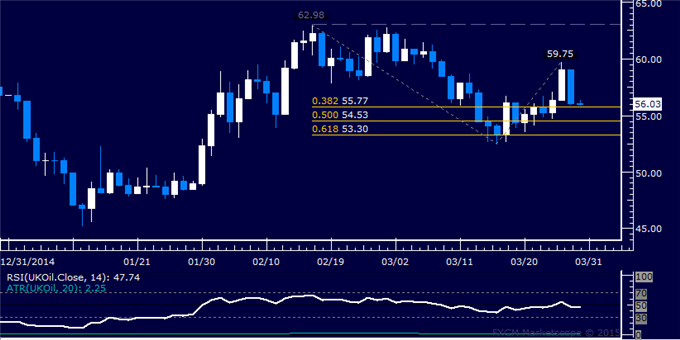

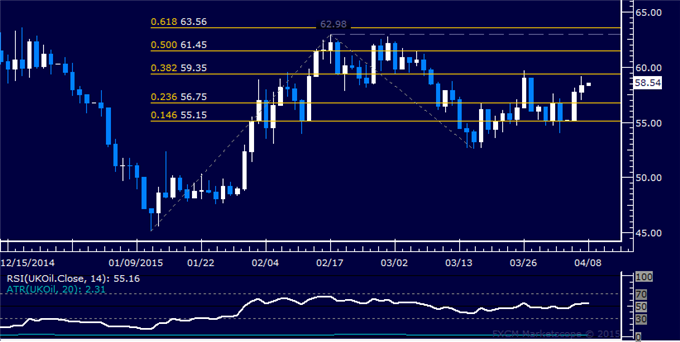

CRUDE OIL TECHNICAL ANALYSIS – Prices reversed sharply lower after finding resistance below the $60/barrel figure. A break below the 38.2% Fibonacci expansion at 55.77 exposes the 50% level at 54.53. Alternatively, a reversal above the March 26 high at 59.75 targets the February 17 high at 62.98.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

More...

7Likes

7Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks